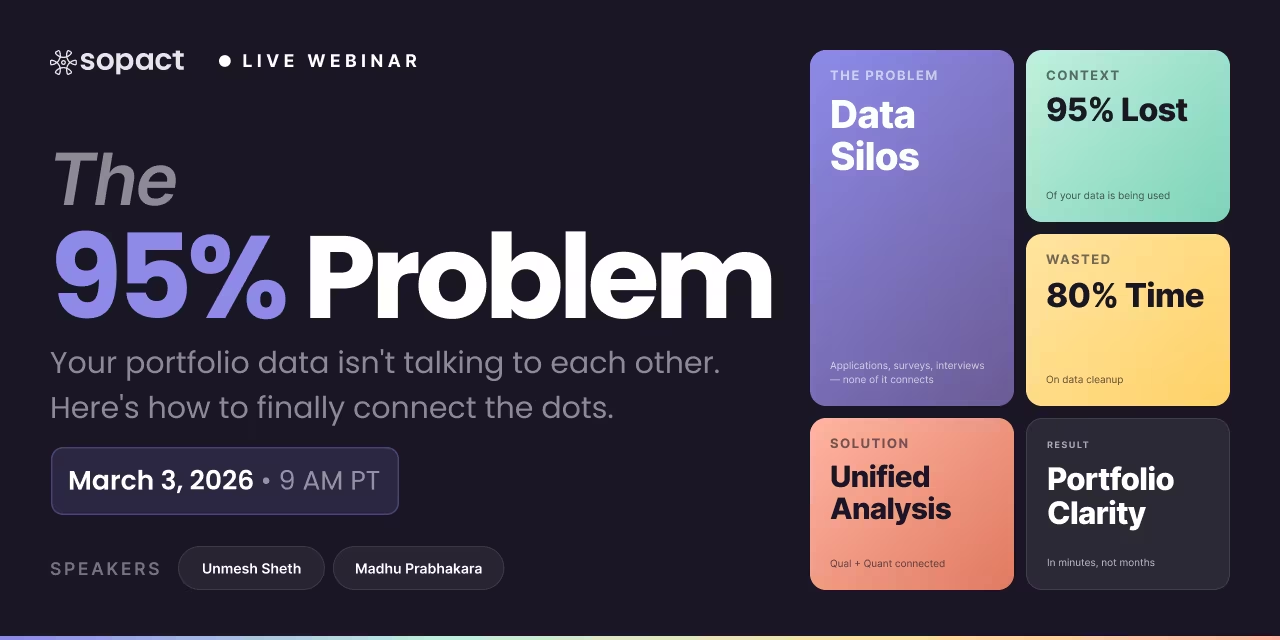

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Stakeholder Intelligence continuously aggregates, understands, and connects all stakeholder data across the lifecycle. Learn the 3-layer architecture.

Every organization has the same problem. You know your stakeholders interact with you through dozens of touchpoints — applications, surveys, interviews, reports, coaching calls, emails, check-ins. You know that inside those interactions is the evidence of what is working, what is not, and what to do next. And you know that almost none of it connects.

The application essay that revealed a founder's real strategy sits in one system. The quarterly check-in that flagged a risk sits in another. The exit interview that explained why outcomes stalled lives in a PDF nobody read. The pre/post survey data that could prove whether your program worked requires three weeks of manual matching across spreadsheets.

This is not a technology problem. You have technology. You have a CRM that stores contacts. A survey tool that collects responses. A drive full of documents. The problem is that none of these tools understand what is inside. They store data. They do not read it, connect it, or explain what it means.

For two decades, the industry tried to solve this with "impact measurement software." It failed — not because measuring impact is wrong, but because every platform built on the same flawed assumption: that the challenge is dashboards and frameworks, when the real challenge is data architecture.

That era is over. What replaces it is Stakeholder Intelligence.

Stakeholder Intelligence is a new category of software that continuously aggregates, understands, and connects qualitative and quantitative data about stakeholders across their entire lifecycle — from first touch to final outcome — turning fragmented data into persistent, actionable intelligence.

That definition is precise and each word matters. Continuously — not once a year. Aggregates — from any source, not just surveys. Understands — AI reads documents, codes open-ended text, detects sentiment, not just stores files. Connects — persistent unique IDs link every interaction across every stage. Lifecycle — intake to outcome to alumni, not just the application.

Stakeholder Intelligence is to impact measurement what business intelligence was to spreadsheet reporting — a category shift from manual, periodic, backward-looking work to continuous, AI-driven, forward-looking understanding.

No existing category captures this. Survey tools collect but do not understand. CRMs store relationships but do not analyze outcomes. Impact measurement tools track metrics but ignore the qualitative evidence that explains them. Grant management platforms coordinate workflow but lose context between stages. Stakeholder Intelligence spans all of these because the problem it solves — turning fragmented stakeholder data into continuous intelligence — requires a new architecture, not a better version of an old one.

Three forces have converged to make Stakeholder Intelligence both possible and necessary. None existed five years ago. All three are now irreversible.

For the first time in history, software can read a 200-page grant report, code 500 open-ended survey responses, detect sentiment in interview transcripts, and connect the qualitative themes to quantitative metrics — automatically, in minutes, at scale.

This capability did not exist when legacy impact measurement tools were designed. NVivo, ATLAS.ti, and MAXQDA were built for a world where qualitative analysis required a trained researcher sitting with transcripts for weeks. SurveyMonkey was built for a world where the best you could do with open-ended responses was export them to a spreadsheet and read them manually.

That world is gone. AI now handles theme extraction, sentiment analysis, rubric scoring, and pattern detection as core capabilities — not premium add-ons, not separate tools. The question is no longer can software understand qualitative data, but which architecture delivers the most trustworthy understanding.

Stakeholder data now lives across CRMs, email, surveys, spreadsheets, documents, chat, video calls, and social platforms. A foundation's relationship with a grantee generates evidence across application forms, uploaded budgets and strategy documents, quarterly narrative reports, site visit notes, interview recordings, annual financial submissions, and informal email updates.

No single legacy tool captures it all. Survey platforms miss documents. CRMs miss program outcomes. Document management systems miss structured data. The result is silos — and the insight locked inside those silos is invisible to decision-makers.

Organizations do not need another tool that captures one more data type. They need aggregation that works across all sources, connecting everything to the right stakeholder automatically.

The reporting cycle has compressed from yearly to quarterly to real-time. Impact investing assets under management hit $1.16 trillion in 2024. Grant management software is projected to reach $4.23 billion by 2030. The pressure is not to produce more reports — it is to produce faster, deeper insight that drives decisions while they still matter.

Annual impact reports are archaeology. By the time the data is cleaned, analyzed, and presented, the program has already moved on. Boards and funders increasingly want to know what is changing now — not what was reported six months ago.

Static measurement tools structurally cannot deliver this. Continuous intelligence requires a platform that collects, analyzes, and connects data in real time — and that is a fundamentally different architecture.

Stakeholder Intelligence is not a feature set. It is an architecture. Sopact Sense delivers it through three layers, each building on the one below.

The foundation layer solves the aggregation problem. Sopact Sense includes built-in surveys and forms, but that is just the starting point. Through AI-native connectors, the platform ingests data from CRM systems, email, spreadsheets, uploaded documents (PDFs, Word files, pitch decks), interview transcripts, file attachments, and any external source that generates stakeholder evidence.

This matters because real stakeholder intelligence requires data that lives outside of any single tool. A fund manager who needs to evaluate a portfolio company cannot rely solely on structured survey responses — the pitch deck, the financial model, the quarterly narrative report, the interview transcript all contain critical context. Layer 1 makes all of it available in one place, automatically linked to the right entity.

A key architectural decision: the data is cleaned at source. Every stakeholder receives a persistent unique ID from first contact. Deduplication happens at collection, not as a cleanup step. Self-correction links allow stakeholders to fix their own data without admin intervention. This eliminates the "80% cleanup tax" that plagues organizations using legacy survey tools — because the data architecture prevents fragmentation from ever occurring.

The second layer solves the disconnection problem. Every person, organization, and partner carries their persistent ID across all lifecycle stages: due diligence → onboarding → quarterly reporting → pre/post analysis → exit follow-up → alumni tracking.

Traditional tools abandon context between stages. The application review system has no connection to the quarterly reporting tool. The pre-program survey lives in a different platform from the post-program assessment. Matching a participant's intake data to their outcome data requires manual work that most organizations never complete.

In Layer 2, a scholarship applicant's motivation essay, their teacher recommendation, their pre-program confidence score, their mid-program reflection, their post-program grade, and their six-month employment status all connect to one profile — automatically. The context from Q1 pre-populates Q2. The narrative builds itself over time.

This is not just convenient. It is architecturally essential for intelligence. You cannot understand trajectories of change from disconnected snapshots. You need the full lifecycle.

The top layer is where "understanding" becomes real. The Intelligent Suite — four AI analysis layers (Cell, Row, Column, Grid) — processes both qualitative and quantitative data simultaneously:

Intelligent Cell analyzes individual data points. Score an essay against a rubric. Extract themes from an open-ended response. Flag missing information in a submission. Detect sentiment in a narrative report. Each data point gets smarter the moment it enters the system.

Intelligent Row synthesizes everything about one stakeholder. Combine their application data, survey responses, uploaded documents, and interview transcripts into a comprehensive profile. Generate a summary that a reviewer can read in two minutes instead of spending two hours with the raw materials.

Intelligent Column compares patterns across an entire cohort. Correlate confidence growth with teaching modality. Identify which program sites produce the strongest outcomes and why. Surface the qualitative themes that distinguish high performers from those who stall.

Intelligent Grid produces portfolio-level synthesis. Board-ready reports that combine quantitative metrics with qualitative evidence. Correlation visuals that link numbers to narrative. Evidence packs that show not just what changed but why it changed and what to do next.

The critical difference from legacy analytics: there is no export step. No separate qualitative analysis tool. No manual coding phase. No loading data from one system into another. The intelligence is continuous because the data, the lifecycle, and the analysis exist in the same architecture.

Stakeholder Intelligence did not emerge from a vacuum. It exists because three structural gaps in today's software landscape leave organizations without the insight they need — not because existing tools are poorly built, but because they were designed for a different era.

For years, understanding qualitative data required specialized text analytics software with proprietary NLP engines. Theme extraction, sentiment analysis, and response coding were premium capabilities that only dedicated tools could deliver.

That era ended when foundation AI models arrived. Today, AI handles theme extraction, sentiment analysis, and qualitative coding as baseline capabilities — faster, more flexibly, and at a fraction of the cost. At the same time, major enterprise platforms are adding native AI analytics into their existing products.

The implication is significant: the analysis itself is becoming commoditized. The lasting value is in the data structure that makes analysis trustworthy. Organizations feeding poorly structured, fragmented data into even the most powerful AI models still get unreliable results. Stakeholder Intelligence solves this at the data layer — ensuring the input is clean, connected, and contextual before any analysis begins.

Survey platforms are essential infrastructure for data collection. But they were designed for tabulation — not for AI-powered analysis. The data they produce is disconnected by design: each form is standalone, there are no persistent participant IDs across surveys, and open-ended responses are typically exported to spreadsheets and left unanalyzed.

The result is what practitioners call the "cleanup tax." Organizations export survey data, spend weeks cleaning and merging across spreadsheets, and still cannot connect a participant's pre-program response to their post-program outcome without manual matching. Research suggests this consumes 40–60% of evaluation teams' time.

When data collection is designed from the start to feed AI analysis — with unique IDs, lifecycle linking, and clean-at-source architecture — that cleanup tax disappears entirely. Stakeholder Intelligence does not replace survey tools. It ensures that what they collect becomes genuinely useful for continuous insight.

Portfolio management solutions do an important job: they aggregate quantitative metrics across investments, grantees, or partner organizations. What they cannot do is analyze the qualitative evidence that explains those numbers.

When a fund manager asks "why did outcomes improve at these three portfolio companies but stall at those two?" — the answer lives in narrative reports, interview transcripts, and open-ended survey responses that sit unread in shared drives. Numbers show what changed. Understanding why requires reading at scale — and until recently, that was not possible.

AI now makes qualitative analysis at portfolio scale achievable. Stakeholder Intelligence brings that capability together with data aggregation and lifecycle management in a single architecture, closing the gap that no existing tool category addresses.

Defining a category also requires saying what it is not. Stakeholder Intelligence is not:

A better dashboard. Dashboards show what was reported. Intelligence explains what it means. If your primary output is a dashboard that displays aggregated metrics without the qualitative evidence behind them, you have reporting, not intelligence.

AI bolted onto a legacy tool. Adding a "Summarize with AI" button to a survey platform does not create intelligence. If the data is still fragmented, disconnected, and lacking lifecycle context, the AI summarizes garbage — faster, but no more usefully.

A CRM with analytics. CRMs manage relationships through transaction records. They were not designed for longitudinal outcome tracking, qualitative data analysis, or evidence-based reporting. Stakeholder Intelligence uses CRM-like identity management as a foundation, but the analysis and lifecycle layers are entirely different.

Impact measurement with a new name. Impact measurement focuses on framework compliance, periodic snapshot data collection, and backward-looking reports. Stakeholder Intelligence is continuous, forward-looking, and draws from all data sources — not just structured surveys.

Every organization that manages stakeholder relationships over time and needs to understand what is changing — and why — is a candidate for Stakeholder Intelligence. The use cases are broader than traditional impact measurement because the architecture is broader:

Foundations and grantmakers who need to track grantee progress from application through outcomes, understand portfolio-level patterns, and generate board-ready reports with both quantitative metrics and qualitative evidence.

Accelerators and incubators managing pipeline from 1,000 applications narrowed to 25 companies, with AI-scored applications, interview analysis, mentor session tracking, milestone monitoring, and outcome evidence packs. Read more about accelerator portfolio management.

Nonprofits and social enterprises running programs where participant registration, service delivery, outcome surveys, and qualitative stories all need to connect across the lifecycle under persistent IDs.

CSR teams aggregating grantee data, stakeholder feedback, and impact stories for ESG reporting and board presentations — drawing from documents, surveys, and partner narratives across the portfolio.

Impact investors tracking portfolio companies from due diligence through exit, needing to correlate quantitative KPIs with qualitative progress signals from interviews, reports, and narrative updates.

Workforce training programs connecting pre-program baselines to mid-program reflections to post-program assessments to long-term employment outcomes — with AI identifying which program elements drive real results.

The common thread: these are all organizations where the stakeholder relationship is longitudinal, the data is multi-source, and understanding why matters as much as knowing what.

Stakeholder Intelligence is not a positioning label — it reflects genuine architectural decisions that are difficult to replicate by adding features to existing tools. These capabilities require building from the ground up:

Clean data at source — unique IDs, deduplication prevention, and relationship linking from first interaction. This cannot be retrofitted onto a tool where each form is standalone.

Stakeholder self-correction — unique correction links allow participants to fix their own data without admin intervention, keeping records accurate without creating admin burden.

Intelligent Suite (Cell → Row → Column → Grid) — AI analysis at every level, from individual data points to portfolio synthesis. This is not a single "summarize" button; it is four distinct analysis layers, each serving a different function.

Document intelligence — analyze lengthy reports, extract themes, apply rubrics, and benchmark across programs. This requires an ingestion architecture that form-based tools were not designed to support.

Qualitative + quantitative in one workflow — open-ended responses, transcripts, and documents are analyzed alongside structured metrics in the same platform. No separate qualitative analysis tool. No export-and-reimport cycle.

Unlimited users and forms — no per-seat pricing, no form limits. This matches the reality of multi-stakeholder programs where grantees, participants, reviewers, and partners all need access.

AI-native, not AI-added — the architecture was designed for AI from day one. When data structures are built to feed AI analysis, the quality of insight is fundamentally different from adding AI features on top of data that was never designed for it.

The shift from legacy tools to Stakeholder Intelligence does not require a multi-month implementation or dedicated technical staff. Sopact Sense is designed for self-service deployment in days, not months:

Start with one use case. Bring in a single program — a grant cycle, a training cohort, a portfolio review. Connect the data sources that already exist: upload spreadsheets, connect your CRM, set up intake forms with persistent IDs.

Let AI analyze what you already have. Upload the documents, transcripts, and open-ended responses you have been collecting but not analyzing. The Intelligent Suite processes them in minutes, surfacing themes, flagging gaps, and generating stakeholder profiles.

Expand the lifecycle. Connect the next stage — follow-up surveys, quarterly reports, exit interviews. Each new touchpoint automatically links to the right stakeholder through persistent IDs, building a richer profile over time.

Scale across programs. Once the architecture is in place for one use case, expanding to additional programs, portfolios, or partner networks uses the same infrastructure. The intelligence compounds.

Stakeholder Intelligence is a new category of software that continuously aggregates, understands, and connects qualitative and quantitative data about stakeholders across their entire lifecycle. Unlike traditional impact measurement tools that capture periodic snapshots through disconnected surveys, Stakeholder Intelligence creates a living, AI-analyzed record from first touch to final outcome — delivering understanding in minutes, not months.

Impact measurement focuses on framework compliance, periodic survey data, and annual reports. Stakeholder Intelligence is continuous, draws from any data source (not just surveys), uses AI to understand qualitative evidence alongside quantitative metrics, and maintains persistent identity across the full lifecycle. Impact measurement tells you what was reported. Stakeholder Intelligence explains what is actually changing and why.

A stakeholder intelligence platform aggregates data from multiple sources (surveys, documents, interviews, CRMs), maintains persistent unique IDs across the stakeholder lifecycle, and uses AI-native analysis to process both qualitative and quantitative data. Sopact Sense is the first purpose-built stakeholder intelligence platform, built on a three-layer architecture: multi-source collection, lifecycle management, and continuous intelligence.

Every legacy impact measurement platform has either shut down, pivoted to ESG, or stalled — including Proof, Impact Mapper, iCuantix, Socialsuite, and Sametrics. They failed because they started with frameworks and dashboards rather than solving the data architecture problem. Without clean data at source, persistent identity, and AI-native analysis, no amount of dashboard sophistication produces meaningful insight.

The three layers are: Layer 1 (Multi-Source Data Collection) — aggregate surveys, documents, interviews, and CRM data under persistent unique IDs. Layer 2 (Lifecycle Management) — connect every touchpoint from intake to outcome to follow-up. Layer 3 (Continuous Intelligence) — AI analysis at four levels (Cell, Row, Column, Grid) that processes qualitative and quantitative data simultaneously.

Sopact Sense includes built-in survey and form collection designed for AI analysis from the start — with persistent IDs, deduplication, and clean-at-source architecture. For many organizations, this replaces standalone survey tools entirely. For others, Sopact ingests data from existing survey platforms through connectors, solving the cleanup tax without requiring a tool switch.

Sopact Sense is designed for self-service deployment in days, not months. Start with one use case, connect existing data sources, and expand the lifecycle over time. No dedicated technical staff required, no multi-month implementation projects, no enterprise-grade complexity.

Sopact Sense offers unlimited users, unlimited forms, and unlimited reports — a fundamentally different model from per-seat or per-form pricing. This matters for organizations where grantees, participants, reviewers, and partners all need access. Pricing depends on deployment model and data volume, but the architecture is designed for mid-market organizations that need deep intelligence without enterprise-grade complexity or cost.