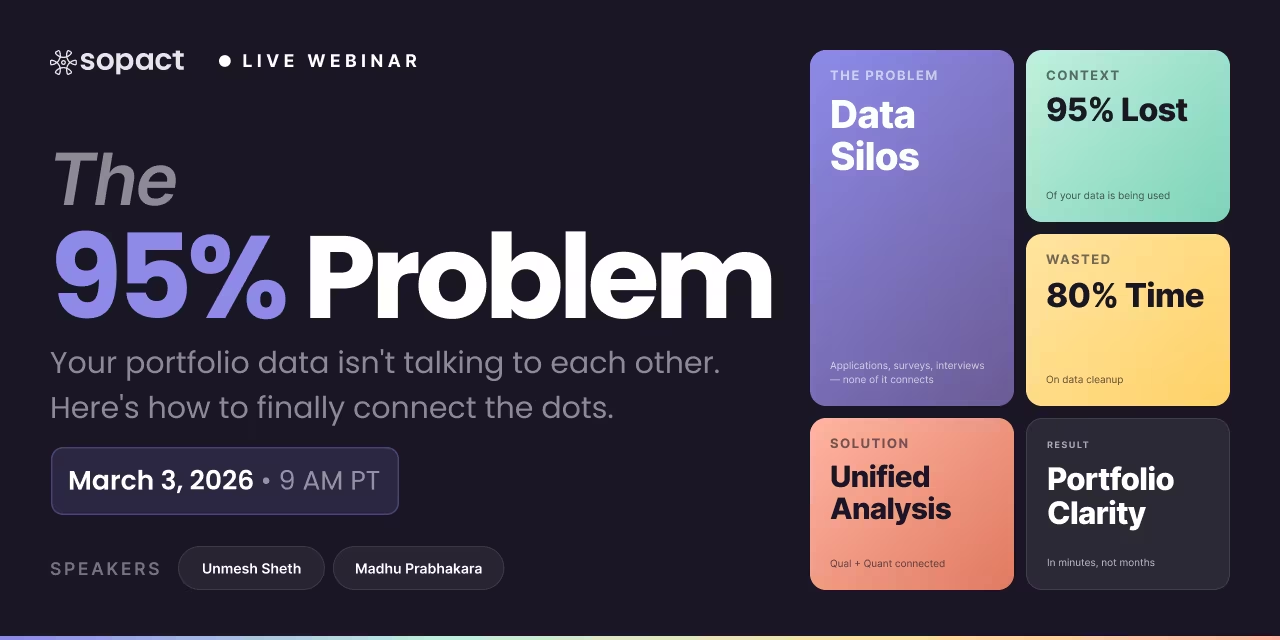

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Your AMS tracks renewals. Your dashboard shows scores. But nobody reads what members actually say. Discover how AI-native member intelligence changes association data analytics.

Your association management software tracks every renewal, event registration, and dues payment with precision. Your analytics dashboard displays engagement scores and renewal predictions in colorful charts. Yet half of all associations report flat or declining membership — and nobody can explain why.

The answer is buried in data you already collect but never analyze: the open-ended survey responses that sit in spreadsheets, the conference evaluations filed away after board meetings, the chapter feedback reports that headquarters skims but never synthesizes. This qualitative data — the data that explains member behavior, not just counts it — represents the largest untapped intelligence asset in the association world.

In 2026, that gap is no longer acceptable. AI-native platforms can now read, code, and connect qualitative member feedback at scale, transforming scattered text into continuous intelligence. The question isn't whether your association needs this capability. It's how long you can afford to operate without it.

📌 HERO VIDEO PLACEMENT

Video: https://www.youtube.com/watch?v=pXHuBzE3-BQ&list=PLUZhQX79v60VKfnFppQ2ew4SmlKJ61B9b&index=1&t=7s

Membership data analytics is the practice of collecting, integrating, and analyzing member data across all touchpoints — from dues payments and event attendance to survey responses, chapter feedback, and open-ended comments — to understand member behavior, predict churn, and improve engagement strategies. Unlike basic reporting dashboards that display what happened, true membership analytics explains why it happened and what's likely to happen next.

Every association collects two fundamentally different kinds of data. The first is quantitative — renewals, event registrations, dues payments, email opens, website visits. This is the data your AMS tracks and your analytics dashboard displays. It tells you what members do.

The second is qualitative — open-ended survey responses, conference evaluations, committee meeting notes, chapter feedback reports, support tickets, member testimonials. This is the data that tells you what members think, feel, and need. It explains the "why" behind every metric on your dashboard.

The problem? Nearly every tool in the association technology stack handles the first type well and ignores the second entirely.

Traditional member engagement analytics relies on scoring models that assign points for activities: attending an event earns 10 points, opening an email earns 2 points, renewing early earns 50 points. These scores create a convenient number, but they mask more than they reveal.

A member with a high engagement score might still leave because the professional development content no longer matches their career trajectory — something they mentioned in three consecutive conference evaluations that nobody connected. A member with a low engagement score might be your strongest advocate, contributing insights in chapter meetings that never reach headquarters.

Engagement scores don't capture intent, satisfaction, or emerging frustration. They measure activity, not understanding.

The association sector faces a structural intelligence gap that no amount of dashboard refinement can close. Research from ASAE reveals that only 29.7% of associations effectively integrate their engagement tools. Meanwhile, 40% lack regular member feedback loops entirely, and 50% of associations report no growth or declining membership in recent benchmarking studies.

These numbers point to a paradox: associations collect more data than ever but understand their members less than ever.

Industry research suggests that 80% of meaningful member data lives outside the association management system. Your AMS captures transactions — who joined, who renewed, who registered for events. But the richest signals about member satisfaction, emerging needs, and potential churn live in:

This qualitative data contains the intelligence associations need to reverse membership declines. But because no tool in the traditional stack can process it at scale, it remains locked in spreadsheets, PDFs, and filing cabinets.

Association management software was built for workflow — managing renewals, processing dues, coordinating events. Platforms like Glue Up, MemberClicks, Wild Apricot, and Fonteva excel at these operational tasks. They ensure bills get sent, events get organized, and member records stay current.

But managing the workflow of membership is not the same as understanding the experience of membership. Your AMS can tell you that 200 members didn't renew last quarter. It cannot tell you that 65% of those members mentioned "lack of career-stage relevance" in their last three survey responses — because your AMS doesn't read survey responses.

Analytics platforms like Association Analytics (Acumen) and Nucleus add a dashboard layer on top of AMS data, providing engagement scoring, renewal prediction, and revenue visualization. These tools answer "how many" and "how likely" questions with increasing sophistication. But they still operate entirely within the quantitative domain. No engagement score model reads the text of what members actually say.

For multi-chapter associations — organizations with 50 to 500+ chapters — the intelligence gap becomes a structural data nightmare.

Each chapter collects its own member feedback through local surveys, event evaluations, and meeting notes. Headquarters attempts to aggregate this data, but it arrives in different formats, at different times, using different questions. Parent organizations and chapters exchange data files continuously but rarely achieve true data synchronicity.

Industry research suggests that only 5% of associations with chapters calculate the ROI of their chapter systems. This astonishingly low number isn't because associations don't care about chapter performance — it's because they literally cannot synthesize the qualitative intelligence their chapters collect.

Consider what happens to chapter feedback today: a regional chapter in the Southeast conducts a member satisfaction survey with open-ended questions. The chapter director reads through 150 responses, picks a few representative quotes for the quarterly report, and sends a summary to headquarters. Headquarters receives similar reports from 40 chapters, skims them for alarming patterns, and files them away.

Nobody aggregates themes across all 40 chapters. Nobody compares this quarter's chapter feedback to last quarter's. Nobody connects what a member said in a chapter survey to what the same member said in a national conference evaluation. The most valuable intelligence — cross-chapter qualitative patterns — evaporates in the reporting process.

Chapter-level feedback is often the earliest warning system for membership churn. Members express frustration, changing needs, and disengagement signals in local interactions long before they decide not to renew nationally. When those signals never reach headquarters in a synthesized, analyzable form, the association misses its best window for intervention.

The data collection architecture determines whether chapter intelligence compounds into organizational understanding or dissipates into unread reports.

The association analytics market has invested heavily in dashboards over the past decade. Platforms like Association Analytics (Acumen) and Nucleus Analytics have built sophisticated visualization layers that aggregate AMS data, event data, email engagement, and community activity into unified views.

These dashboards answer important questions: Which members are most likely to renew? Which events drive the highest engagement scores? Which member segments generate the most revenue? For quantitative pattern recognition, modern analytics dashboards deliver genuine value.

But dashboards have a fundamental limitation: they can only display what they can quantify. And the most important member intelligence is qualitative.

When your analytics platform tells you that renewal probability for mid-career members in the Northeast region dropped 12% this quarter, that's a useful signal. But it doesn't tell you why. The "why" lives in the 800 open-ended comments from your annual satisfaction survey, the 40 chapter reports submitted last quarter, and the 200 conference evaluation forms from your last event.

No amount of dashboard refinement, however beautiful, can read text. No engagement score, however sophisticated, can detect emerging themes in member feedback. No renewal prediction model, however accurate, can explain the human reasons behind its predictions.

The association analytics industry has conflated visualization with understanding. A dashboard shows you the shape of a problem. Intelligence tells you the substance of it.

Question TypeDashboard AnswerIntelligence AnswerWhy are mid-career members leaving?"Renewal rate dropped 12%""67% cite 'content relevance' declining; theme emerged 18 months ago in chapter surveys"What do members value most?"Conference attendance up 8%""Members consistently describe 'peer networking' as primary value; 'keynote quality' declining as theme"How are chapters performing?"Southeast chapter: 85% renewal""Southeast members praise local mentoring program; request more industry-specific content"What should we invest in next?"Revenue per member: $450""Emerging theme across 3 chapters: demand for micro-credentialing; 40+ mentions in Q4 feedback"

The association sector's AI adoption curve reveals a telling pattern. Research from the digitalNow 2025 conference describes associations as being in "AI adolescence" — past experimentation but struggling to scale meaningful implementations. Among associations actively exploring AI, the dominant use cases are predictive renewal scoring, email personalization, and chatbot deployment.

These applications treat AI as an optimization layer for existing quantitative workflows. They make dashboards smarter but don't fundamentally change what associations can understand about their members.

The AI capability that transforms member intelligence isn't prediction — it's comprehension. Modern AI can read, code, and analyze thousands of open-ended text responses simultaneously, extracting themes, tracking sentiment shifts, identifying emerging issues, and connecting qualitative patterns to quantitative metrics.

This capability already exists in the consumer experience (CX) industry, where companies like Amazon, Uber, and Spotify have long used AI to analyze customer feedback at scale. The feedback analytics category (Kapiche, Chattermill, Thematic) built entire businesses around this capability for enterprise CX teams.

But that same AI capability has never been systematically applied to association member feedback — where qualitative data from chapters, events, surveys, and committees sits unanalyzed in spreadsheets. The tools that analyze Amazon customer reviews have no equivalent in the association world.

This is the gap: not better dashboards, but actual comprehension of what members say, think, and need — connected across every interaction over time.

When AI reads member feedback at scale, it performs several operations that no human team can replicate consistently:

Theme Extraction: Automatically identifies recurring topics across hundreds or thousands of responses. Instead of a staff member skimming 800 survey responses and reporting "members seem concerned about relevance," AI codes every response, counts exact theme frequencies, and tracks theme emergence over time.

Sentiment Tracking: Measures not just whether feedback is positive or negative, but how sentiment shifts across member segments, time periods, and topics. A slow negative drift in sentiment around professional development content becomes visible months before it appears in renewal rates.

Cross-Source Synthesis: Connects what a member said in a satisfaction survey to what they wrote in a conference evaluation to what their chapter reported in quarterly feedback. This longitudinal, cross-source view is impossible to construct manually at scale.

Emerging Issue Detection: Identifies topics that are increasing in frequency before they become dominant themes. Early detection of emerging member concerns gives associations the lead time they need to respond proactively rather than reactively.

The solution to the association intelligence gap isn't replacing your AMS or your analytics dashboard. It's adding a layer that neither can provide: qualitative intelligence connected to persistent member identities.

Stakeholder intelligence platforms aggregate feedback from any source — surveys, chapter reports, event evaluations, committee notes, support tickets, interviews — and apply AI-native analysis to extract meaning. Unlike analytics dashboards that require structured, quantitative data, stakeholder intelligence platforms work with unstructured qualitative text as their primary input.

For associations, this means three transformative capabilities:

Aggregate Anything: Ingest member feedback from every touchpoint regardless of format. A chapter's quarterly PDF report, a SurveyMonkey export with open-ended responses, an event evaluation spreadsheet, and committee meeting notes all flow into a single intelligence layer. No reformatting, no manual data entry, no standardization gymnastics.

Understand Everything: AI natively reads, codes, and analyzes qualitative data alongside quantitative metrics. Theme extraction, sentiment analysis, emerging issue detection — across thousands of member responses simultaneously. The same AI that reads survey text also processes chapter reports and event evaluations, building a unified qualitative picture.

Connect Forever: Persistent unique member IDs link every qualitative interaction to the same member across years. A member's 2024 onboarding survey, 2025 conference evaluation, and 2026 satisfaction feedback are all connected — revealing longitudinal patterns no dashboard can show. This 360-degree feedback approach transforms disconnected data points into continuous member intelligence.

Several AMS vendors have announced AI features in recent years. These typically take the form of chatbots, predictive scoring models, or summarization features bolted onto existing architectures. While these features add convenience, they don't address the fundamental gap.

Adding AI to an AMS is like adding a translator to a library that only contains phone books. The translator is capable, but the source material limits what can be understood. True member intelligence requires an AI-native architecture designed from the ground up to process qualitative text, maintain persistent identities, and connect insights across sources and time periods.

The distinction matters: AI-enhanced AMS makes existing quantitative workflows slightly smarter. AI-native stakeholder intelligence creates an entirely new category of understanding that previously didn't exist at scale.

The terminology in association technology can obscure meaningful distinctions. Here's how the three layers of the association data stack compare:

What it does: Manages operational workflows — membership records, dues processing, event coordination, communications. Examples: Glue Up, MemberClicks, Wild Apricot, Fonteva.

What it answers: Who are our members? When do they renew? What events did they attend? How much revenue did they generate?

What it can't do: Analyze any qualitative text. Read survey responses. Synthesize chapter feedback. Detect emerging themes.

What it does: Aggregates quantitative data from AMS, events, email, and community platforms into visual dashboards. Provides engagement scoring, renewal prediction, and revenue analysis. Examples: Association Analytics (Acumen), Nucleus Analytics.

What it answers: How engaged are members? Who's likely to renew? Which segments are growing? What's our revenue trend?

What it can't do: Analyze open-ended text. Read conference evaluations. Compare qualitative chapter feedback. Track sentiment changes over time.

What it does: Aggregates and analyzes both quantitative and qualitative data from any source, using AI to extract themes, track sentiment, detect emerging issues, and connect insights to persistent member identities across time.

What it answers: Why are members leaving? What themes are emerging in chapter feedback? How has member sentiment about professional development shifted over three years? What do members in declining segments actually say they need?

What makes it different: Processes qualitative text as primary input. Maintains persistent member IDs across all interactions. Connects qualitative and quantitative data in a single analysis. Works with any format from any source.

The most effective entry point is your existing annual member satisfaction survey. Most associations already collect open-ended responses but never analyze them systematically. Upload your most recent survey data — including all open-ended responses — into an AI-native platform and see what themes emerge.

You'll likely discover patterns that manual skimming missed entirely: specific topics clustering in unexpected member segments, sentiment differences between renewal-likely and churn-likely members, and emerging issues that hadn't yet appeared on your radar.

Once your satisfaction survey is producing intelligence, layer in conference and event evaluation data. Connect evaluation responses to the same member IDs from your survey. You'll begin to see longitudinal patterns: how a member's event feedback correlates with their satisfaction survey responses, whether conference experiences influence renewal behavior, and which event formats generate the most positive qualitative themes.

For multi-chapter associations, the highest-value application is cross-chapter qualitative analysis. When AI can read and code chapter reports from all regions simultaneously, headquarters gains a capability it has never had: understanding what chapters are hearing from members on the ground, compared across regions and tracked over time.

This is where the continuous feedback lifecycle model transforms association decision-making. Instead of waiting for annual benchmarking studies to reveal trends, chapter intelligence flows continuously, enabling proactive strategy adjustments.

The end state is a continuous intelligence system where every member interaction generates analyzable data: surveys, evaluations, chapter feedback, support interactions, committee discussions. All connected to persistent member IDs. All analyzed by AI. All feeding a living intelligence brief that shows not just what's happening with membership, but why.

This transition from periodic reporting to continuous intelligence mirrors the broader shift in impact measurement methodology — from annual compliance exercises to real-time learning systems.

Membership data analytics is the practice of collecting and analyzing member data across all touchpoints to understand engagement patterns, predict retention, and improve association strategies. It encompasses both quantitative metrics like renewal rates and event attendance, and qualitative analysis of member feedback, survey responses, and chapter reports. Effective membership analytics goes beyond dashboards to explain why members behave the way they do.

AI-native analysis platforms can process hundreds or thousands of open-ended responses simultaneously, extracting themes, tracking sentiment, and identifying emerging patterns. Upload your survey export including all text responses, and AI will code each response, categorize themes, measure sentiment, and generate a synthesized intelligence report. This replaces manual skimming that typically captures only surface-level patterns from a fraction of responses.

Stakeholder intelligence is an AI-native approach that aggregates and analyzes member data from every source — surveys, chapter reports, event evaluations, committee notes, support tickets — using persistent unique member IDs to connect all interactions over time. Unlike analytics dashboards that display quantitative metrics, stakeholder intelligence reads and understands qualitative text, revealing why members behave the way they do.

Multi-chapter data aggregation requires a platform that accepts any format — PDFs, spreadsheets, survey exports, narrative reports — and normalizes the data automatically. AI-native platforms can ingest chapter reports from dozens of chapters simultaneously, extract qualitative themes, compare patterns across regions, and connect chapter-level feedback to national member IDs. This eliminates the manual reconciliation that makes cross-chapter analysis impractical with traditional tools.

AI enhances churn prediction by adding qualitative signals to quantitative models. Traditional renewal prediction uses engagement scores, tenure, and activity patterns. AI-native analysis adds sentiment trends from survey responses, emerging frustration themes from chapter feedback, and declining satisfaction signals from event evaluations. This qualitative context makes predictions more accurate and, critically, more actionable — because you know why members are at risk, not just that they are.

An AMS manages operational workflows — renewals, events, dues, communications. A membership intelligence platform analyzes qualitative and quantitative member data to explain behavior patterns. They serve different purposes: an AMS tells you what members do, intelligence tells you why. Most associations need both — the AMS for operations and an intelligence layer for understanding. The intelligence platform doesn't replace your AMS; it fills the qualitative analysis gap that AMS systems were never designed to address.

With AI-native platforms, initial insights from existing survey data can be generated within hours of uploading. Meaningful pattern recognition across multiple data sources typically develops within the first month as data accumulates. Longitudinal intelligence — tracking how member sentiment and themes shift over time — builds progressively as more feedback cycles are connected. The transition from periodic to continuous intelligence typically takes two to three quarters.

Open-ended survey responses are the highest-value starting point because they contain direct member voice data that explains quantitative metrics. Conference and event evaluations provide context about program quality and relevance. Chapter feedback reports reveal regional patterns that national surveys miss. Support tickets indicate friction points in the member experience. The combination of these sources, connected through persistent member IDs, creates the most complete intelligence picture.