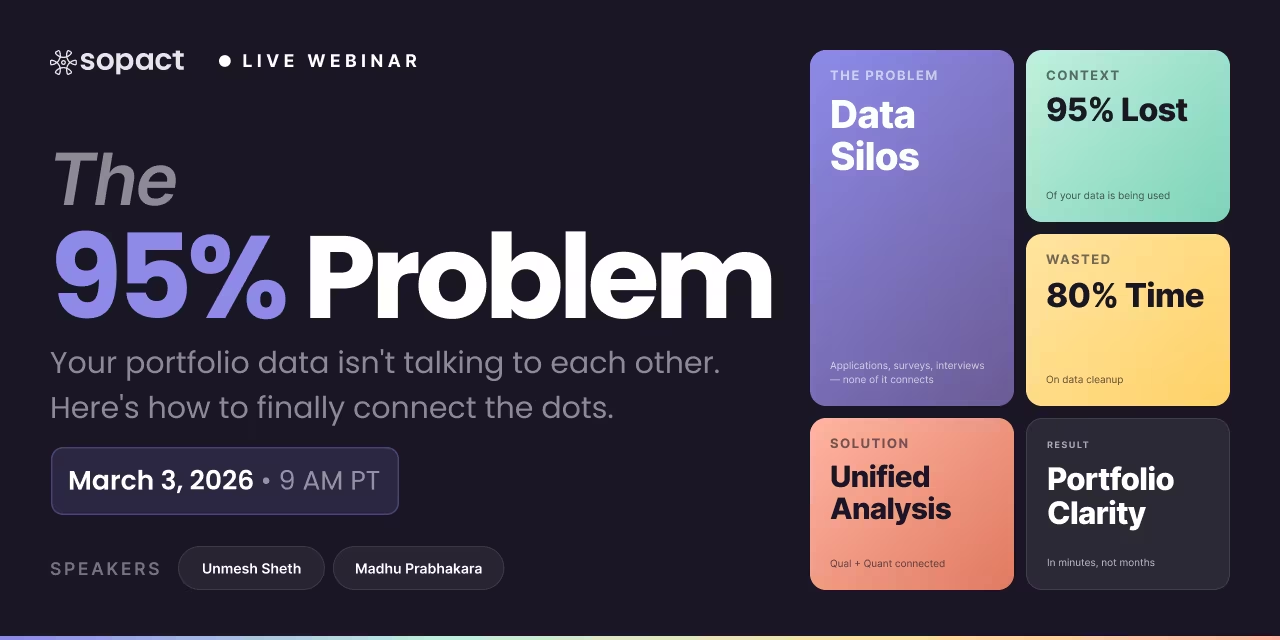

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Calculate your social return on investment (SROI) with our free calculator, step-by-step formula guide, and AI-powered framework. Learn how to measure SROI in 2026.

Calculator, Formula & AI-Powered Framework

TL;DR: Social Return on Investment (SROI) measures the social, environmental, and economic value created per dollar invested, expressed as a ratio like 3.5:1. Traditional SROI takes 3–12 months and depends on expensive consultants because organizations spend 80% of their time cleaning fragmented data before any calculation begins. AI-driven continuous SROI — powered by platforms like Sopact Sense — delivers first insights in 1–7 days by keeping data clean from collection and using AI to analyze qualitative and quantitative feedback simultaneously. The shift transforms SROI from a backward-looking compliance exercise into a real-time learning system that helps organizations improve programs while they are still running.

Social Return on Investment (SROI) is an outcomes-based measurement framework that assigns dollar values to the social, environmental, and economic changes created by a program, then compares that total value against the cost of the investment. The result is a ratio — such as 3.5:1, meaning every dollar invested generated $3.50 of social value.

SROI emerged in the late 1990s, developed by the Roberts Enterprise Development Fund and later standardized by Social Value UK. Unlike traditional financial returns that track only profit, SROI captures intangible outcomes — confidence gained, skills learned, health improved, environments preserved — by translating them into financial equivalents using proxy values.

The methodology answers a fundamental question every funder, program manager, and policymaker asks: "What difference did we actually make, and was it worth the investment?" SROI provides both the ratio (a number for comparison) and the narrative (the stakeholder voices that explain why change happened).

In 2026, SROI is experiencing a critical evolution. Traditional SROI treated impact measurement as a one-time consulting engagement — expensive, backward-looking, and too slow to inform real-time decisions. Continuous SROI, powered by AI-native platforms like Sopact Sense, transforms this into an always-on learning system where impact ratios update automatically as new stakeholder data arrives.

Bottom line: SROI measures social value per dollar invested using a standardized six-stage framework, and is evolving from retrospective consulting engagements into continuous AI-driven learning systems.

SROI is calculated by dividing the net present value of all social outcomes by the total investment, producing a ratio that shows how much social value each dollar creates. The standard formula is: SROI Ratio = Net Present Value of Benefits ÷ Total Investment.

Here is how to apply the formula step by step:

Step 1: Map all outcomes. Identify every social, environmental, and economic change your program creates for each stakeholder group. A workforce training program might map outcomes like increased employment, higher wages, improved confidence, and reduced reliance on public benefits.

Step 2: Assign financial proxies. Translate each outcome into a dollar value using proxy measurements. "Improved mental health" might use the avoided cost of counseling sessions. "Increased employment" might use median wage gains in your region. The Global Value Exchange and Social Value UK provide searchable proxy databases for common outcomes.

Step 3: Apply adjustment factors. Reduce the gross value by accounting for three critical adjustments:

Step 4: Discount for time. Apply a discount rate (typically 3–5%) to future-year values, converting them to net present value. This accounts for the principle that a dollar of social value today is worth more than a dollar of social value five years from now.

Step 5: Calculate the ratio. Divide the total adjusted, discounted value by the total investment.

A youth workforce training program invests $200,000 annually. Here is a simplified calculation:

This means every dollar invested created approximately $5.40 of social value across the three-year evaluation period. The calculation above is simplified — real SROI analysis would include multiple stakeholder groups, additional outcomes (confidence, health, community effects), and more granular adjustment factors.

Bottom line: The SROI formula divides the net present value of adjusted social outcomes by total investment, requiring careful proxy selection, deadweight/attribution/drop-off adjustments, and time discounting to produce a credible ratio.

The SROI framework is a six-stage methodology, standardized by Social Value UK, that guides organizations from scoping through calculation to reporting. Each stage builds on the previous one, and in modern continuous approaches, the stages operate as interconnected feedback loops rather than a linear sequence.

Define the boundaries of your analysis — which program, what timeframe, and which stakeholders are affected. Identify everyone whose life changes because of your intervention: direct participants, families, communities, funders, delivery partners, and government agencies. The principle of stakeholder involvement means the people experiencing change must help define what outcomes matter.

Build an impact map connecting inputs (resources invested) → activities (what you do) → outputs (what you produce) → outcomes (what changes for stakeholders). This map is essentially a theory of change specific to your SROI analysis. Track both intended outcomes and unintended consequences — positive or negative — that emerge during the program.

Collect data proving outcomes actually occurred through surveys, interviews, observation, or administrative records. Then assign financial proxy values to each outcome. This stage requires the most judgment: selecting proxies that stakeholders agree represent the value they experienced. Common proxy sources include government cost databases, labor statistics, academic willingness-to-pay studies, and market replacement costs.

Apply adjustment factors — deadweight, attribution, displacement, and drop-off — to isolate the change your program actually caused. This stage requires honest assessment: what would have happened without your intervention? What other organizations contributed? Did your program shift problems to another population? Each adjustment reduces your gross value toward a credible net impact figure.

Sum all adjusted and discounted outcome values, then divide by the total investment to produce your ratio. Conduct sensitivity analysis to show how the ratio changes when you vary key assumptions — different proxy values, higher deadweight, lower attribution. A robust SROI demonstrates that even under conservative assumptions, the program creates meaningful social value.

Share findings with stakeholders and — critically — use the insights to improve your programs. Reporting is not the end goal; organizational learning is. The organizations that gain the most from SROI are those that embed the practice into their ongoing operations rather than treating it as a one-time compliance exercise.

Bottom line: The six-stage SROI framework moves from scope definition through outcome mapping, evidence collection, impact calculation, and ratio computation to reporting — and the most valuable step is using the insights to improve programs continuously.

Traditional SROI takes 3–12 months because organizations spend 80% of their time cleaning fragmented data from disconnected tools before any calculation begins. Surveys live in one system, CRM data in another, interview transcripts in spreadsheets, and follow-up feedback in email threads — requiring extensive manual reconciliation before a single proxy value can be assigned.

Most organizations collect stakeholder information through five or more disconnected tools. Registration goes into a CRM, pre-program surveys into Google Forms, attendance into spreadsheets, qualitative interviews into Word documents, and post-program follow-up into a different survey platform. When SROI analysis begins, evaluators spend weeks matching participant records across systems, removing duplicates, and standardizing formats. This fragmentation is not a minor inconvenience — it is the primary bottleneck that makes traditional SROI unsustainable.

SROI requires integrating stakeholder narratives — what participants say about the change they experienced, in their own words. Traditional approaches require a researcher to read every interview transcript, manually code themes, and interpret patterns. For a program with 200 participants, this alone can take 6–8 weeks. The subjectivity of manual coding also introduces inconsistency: two analysts may categorize the same response differently.

By the time a traditional SROI report is finished, the program cohort has graduated, staff have rotated, and the next funding cycle has already been planned. The insights that should inform program design become historical documentation instead. A workforce training program that discovers confidence-building workshops had the highest impact ratio cannot apply that finding until the next cohort — months later.

SROI's technical complexity — proxy selection, attribution calculations, sensitivity analysis, discount rates — typically requires external consultants. This makes each evaluation expensive, difficult to repeat consistently across programs, and dependent on outside help. Organizations never build the internal capacity to run SROI themselves as an ongoing practice.

Bottom line: Traditional SROI takes months because fragmented data requires manual reconciliation, qualitative coding is time-intensive, and consultant dependency makes each evaluation a standalone project rather than a continuous capability.

Continuous SROI eliminates the fragmentation and delay of traditional approaches by keeping data clean from collection, using AI to analyze qualitative feedback automatically, and updating impact ratios in real-time as new stakeholder data arrives. First insights appear in 1–7 days instead of 3–12 months.

Rather than collecting data in silos and reconciling later, continuous SROI systems centralize everything from day one. Each participant receives a persistent unique ID at first contact — through registration, application, or intake. Every subsequent touchpoint links back automatically: surveys, feedback forms, uploaded documents, interview notes, and follow-up contacts. This eliminates duplicate records, preserves complete participant journeys, and ensures analysis draws from connected data rather than fragmented snapshots. Sopact Sense's contact system assigns these unique IDs automatically, so the "which Sarah is this?" problem disappears entirely.

When participants share feedback through open-ended responses, AI extracts themes, sentiment, outcome indicators, and confidence levels in minutes — not the weeks required for manual coding. Sopact's Intelligent Cell reads individual responses and detects skills gained, barriers encountered, or satisfaction patterns. Intelligent Row synthesizes each participant's complete journey across all touchpoints. Intelligent Column compares patterns across your entire cohort. And Intelligent Grid generates portfolio-level reports combining qualitative narratives with quantitative metrics.

As new stakeholder outcomes arrive, impact ratios recalculate automatically. Program managers see live impact dashboards showing current SROI performance. When patterns shift — a particular program component drives higher outcomes, or a demographic group shows declining engagement — teams know immediately and can adapt while the program is still running. Sensitivity analysis that took days with spreadsheets now takes minutes: change a proxy value, and the entire model recalculates instantly.

Traditional SROI delivers first insights in 4–12 weeks at baseline consulting cost. Dashboard approaches take 12–52 weeks to build and cost 120–300% of baseline. Continuous AI-driven SROI from Sopact delivers first insights in 1–7 days at roughly 10–20% of baseline cost — approximately 10× cheaper through automation of data cleaning, qualitative analysis, and report generation.

Bottom line: Continuous SROI works by keeping data clean from collection, using AI to analyze qualitative feedback in real-time, and automatically recalculating impact ratios as new data arrives — transforming a months-long consulting engagement into an always-on learning system.

Yes — real-time SROI becomes feasible when data remains analysis-ready throughout the program lifecycle. Instead of gathering data annually and spending months on cleanup, continuous systems collect clean data at every stakeholder touchpoint and update SROI ratios automatically as new outcomes arrive. This enables adaptive program management rather than delayed annual reporting.

Real-time SROI requires three capabilities that traditional tools cannot provide: persistent stakeholder tracking with unique IDs across all touchpoints, integrated qualitative-quantitative analysis that processes open-ended feedback alongside survey metrics, and automated proxy application that recalculates ratios with each new data submission.

The distinction matters practically. An after-school education program running traditional SROI discovers in October that summer reading components had the strongest impact — but the next summer is nine months away. The same program with continuous SROI sees reading impact patterns emerging in real-time during June, enabling immediate curriculum reinforcement for current participants.

Bottom line: Real-time SROI requires clean-at-source data collection, AI-powered qualitative analysis, and automated ratio recalculation — capabilities that turn SROI from a retrospective report into a live program management tool.

SROI applies to any program where social outcomes can be identified, evidenced, and valued — spanning workforce development, education, health, housing, and environmental sectors. The following examples illustrate how different organizations calculate and apply SROI ratios in practice.

A youth employment program investing in job readiness training, mentoring, and placement support calculates SROI by valuing employment outcomes (wage gains), reduced public benefit dependency (government cost savings), and improved mental health (avoided healthcare costs). Typical SROI ratios for well-designed workforce programs range from 2:1 to 7:1, depending on program intensity and participant retention.

A pre-kindergarten program values outcomes including school readiness scores (projected future earnings gains), reduced special education referrals (avoided costs), and improved parenting practices (family stability proxies). Longitudinal SROI studies of early childhood programs, including analyses informed by the Perry Preschool and Abecedarian studies, have shown ratios exceeding 7:1 when calculated over participants' lifetimes.

A diabetes prevention program targeting at-risk populations values outcomes including reduced hospital admissions (avoided treatment costs), improved quality-adjusted life years (willingness-to-pay proxies), and increased community physical activity (healthcare system savings). Health-focused SROI typically ranges from 1.5:1 to 5:1 depending on time horizon and included outcomes.

A housing-first program for individuals experiencing homelessness values reduced emergency room visits, decreased incarceration rates, improved employment, and enhanced quality of life. Housing SROI studies frequently show ratios of 2:1 to 4:1, reflecting the high public costs of homelessness that supportive housing avoids.

A community reforestation program values carbon sequestration (carbon credit market prices), improved water quality (avoided treatment costs), biodiversity preservation (contingent valuation studies), and community recreation access (travel cost methods). Environmental SROI requires creative proxy selection since many ecological benefits lack direct market prices.

Bottom line: SROI applies across sectors — from workforce training to environmental conservation — with each domain requiring specific financial proxies, stakeholder groups, and outcome timeframes tailored to the program's theory of change.

SROI is one of four major impact measurement approaches, each designed for different purposes. SROI measures social value per dollar invested using financial proxies. Logic models map causal pathways without monetizing outcomes. Cost-benefit analysis compares financial costs against financial benefits only. Randomized controlled trials establish causal impact through experimental design with control groups.

SROI's unique strength is combining stakeholder voice with monetized outcomes — participants define what change matters, and financial proxies make that change comparable across programs. Logic models are the best starting point for any evaluation (they map how change happens), but they do not quantify value. Cost-benefit analysis excludes non-monetary social value entirely. RCTs provide the strongest causal evidence but are expensive, slow, and often impractical for community programs.

The most effective approach for most organizations in 2026 is to combine a theory of change (logic model) with SROI methodology, using AI-driven platforms to handle the data collection, qualitative analysis, and ratio calculation that traditionally required months of consultant time.

SROI provides the most complete picture of social value by combining monetary valuation with stakeholder voice. A theory of change is the best starting point regardless of which method you choose — and AI-driven platforms like Sopact Sense make SROI practical for organizations that previously found it too expensive and time-consuming.

Bottom line: SROI is best for communicating social value to funders and comparing programs; use it alongside a theory of change and consider AI-driven platforms to make the methodology sustainable.

Financial proxy selection depends on your specific outcomes, stakeholder context, and geographic location. The most credible SROI analyses use multiple proxy sources per outcome and conduct sensitivity analysis showing how different values affect the final ratio.

Common proxy sources include:

The Global Value Exchange and Social Value UK provide searchable databases of proxies used in previous SROI studies. Always adjust proxy values for your geography, population, and timeframe. A proxy derived from London healthcare costs does not apply directly to a rural South Asian health program without significant adjustment.

The most important principle is transparency: document every proxy choice, explain your rationale, and show what happens to the SROI ratio if you use different values. Sensitivity analysis is not optional — it is what separates credible SROI from advocacy disguised as measurement.

Bottom line: Use government databases, labor statistics, academic research, and market prices as proxy sources — and always document your rationale and run sensitivity analysis to demonstrate that your SROI ratio holds under different assumptions.

SROI faces legitimate criticism because financial proxy selection, attribution percentages, and deadweight estimates all involve judgment calls that different analysts may resolve differently. Two evaluators can produce different ratios for the same program, and stakeholder voices often get filtered through researcher interpretation rather than direct testimony.

Three specific sources of subjectivity weaken SROI credibility:

Proxy selection variability. Valuing "improved confidence" at $2,000 per person (using a therapy-cost proxy) versus $500 (using a self-help-book proxy) produces dramatically different ratios. Without transparent documentation of why one proxy was chosen over another, funders cannot evaluate whether the ratio is reasonable.

Attribution judgment. Deciding that your program caused 70% versus 50% of an employment outcome is a judgment call that directly changes the ratio. Traditional SROI offers no standardized method for making this determination — it depends on the evaluator's assessment.

Stakeholder representation. SROI's founding principle is that stakeholders define value. In practice, evaluation timelines and budgets often limit stakeholder engagement to a subset of participants, potentially biasing which outcomes get valued and how.

These criticisms do not invalidate SROI — they make transparency essential. Modern platforms address subjectivity by linking every claim to specific participant feedback, maintaining auditable evidence trails, and enabling instant sensitivity analysis that shows how the ratio changes when assumptions vary. When funders can see both the calculated value and the lived experiences behind it, they can form their own judgment about credibility.

Bottom line: SROI's subjectivity in proxy selection, attribution, and stakeholder representation is a legitimate concern — addressed best through transparent documentation, direct stakeholder quotes linked to outcomes, and sensitivity analysis showing how assumptions affect the ratio.

SROI becomes a continuous learning system when organizations embed impact measurement into daily operations rather than treating it as a periodic compliance exercise. This requires three architectural shifts: clean data from collection, automated qualitative analysis, and live feedback loops to program teams.

From annual reports to live dashboards. Traditional SROI produces a static report every 6–12 months. Continuous SROI generates a live dashboard updated with every new stakeholder response. Program managers see current SROI performance alongside qualitative themes, outcome trends, and demographic breakdowns — all in real time.

From consultant dependency to organizational capability. Traditional SROI requires external evaluators for each engagement. Continuous SROI builds internal measurement capacity: teams design their own data collection workflows, AI handles the complex analysis, and staff focus on interpreting findings and improving programs. The organization learns to measure its own impact rather than outsourcing the capability.

From proving to improving. The most important shift: SROI stops being about justifying past spending to funders and starts being about learning what works for current participants. When a program team sees mid-program data showing confidence-building workshops outperforming lecture-based sessions, they can reallocate time and resources immediately — not after the annual report arrives.

This is the transformation Sopact Sense enables: impact measurement that feeds directly into program improvement cycles, not just funder reports.

Bottom line: SROI becomes a learning system when organizations shift from annual consulting engagements to embedded, AI-driven measurement that delivers live insights and builds internal evaluation capacity.

SROI adjustment factors — deadweight, attribution, displacement, and drop-off — are the mechanisms that separate credible impact claims from overstated ones. Applying these adjustments honestly is what makes SROI analysis trustworthy rather than self-serving.

Deadweight measures what would have happened anyway without your program. If 30% of your workforce training participants would have found jobs regardless of your intervention, subtract 30% of employment outcome value. Estimating deadweight requires comparison data: control groups, regional employment rates, or historical baselines for similar populations.

Attribution accounts for other organizations or factors contributing to the same outcome. If participants also received mentoring from another nonprofit, job leads from a government program, and family support, your program cannot claim 100% credit for their employment. Estimate each contributor's share and claim only yours.

Displacement asks whether your program's positive outcomes displaced negative effects elsewhere. If your job placement program helped participants secure roles that other unemployed individuals would have filled, the net social benefit is reduced. Displacement is often the most difficult adjustment to estimate and the most frequently overlooked.

Drop-off accounts for the declining value of outcomes over time. Employment gains in year one may persist at 85% in year two and 70% in year three. Apply a percentage reduction to each future year's value to reflect this natural decline before discounting for time value.

Bottom line: Deadweight, attribution, displacement, and drop-off are the four adjustment factors that convert gross social value into credible net impact — applying them honestly is what separates rigorous SROI from advocacy.

Evaluative SROI measures actual outcomes after a program has been delivered, using real stakeholder data collected during and after the intervention. Forecast SROI predicts expected social value before a program begins, using assumptions, comparable evidence from similar programs, and projected outcomes.

Evaluative SROI is more credible because it relies on observed data — what actually happened to real participants. However, it requires robust data collection infrastructure that tracks stakeholders from baseline through post-program follow-up. Organizations building measurement capability should prioritize evaluative SROI as their primary methodology.

Forecast SROI is useful for planning and fundraising — projecting the expected return on a proposed investment helps funders compare options and allocate resources. But forecast SROI carries inherent uncertainty: projections depend on assumptions about participation rates, outcome achievement, and proxy values that may not hold in practice.

The strongest approach combines both: forecast SROI to plan and secure funding, then evaluative SROI to validate whether the predicted value materialized. Continuous measurement platforms make this loop practical by collecting data throughout the program lifecycle and comparing projected versus actual outcomes in real time.

Bottom line: Evaluative SROI measures what actually happened using real data; forecast SROI projects future value for planning — the strongest practice uses both in a continuous loop comparing predicted versus actual outcomes.

Traditional SROI analysis takes 3–12 months because organizations spend 80% of their time reconciling fragmented data from disconnected systems before any calculation begins. AI-driven continuous platforms like Sopact Sense reduce this to 1–7 days by keeping data clean from collection and automating qualitative coding that previously required weeks of manual analysis.

SROI requires qualitative data — stakeholder narratives — to select appropriate proxies and validate that outcomes actually occurred as described. Traditional approaches use manual interview coding, which is time-intensive and inconsistent. AI-powered platforms extract themes, sentiment, and outcome indicators from open-ended responses automatically, processing hundreds of narratives in minutes rather than weeks.

Longitudinal SROI tracking requires connecting baseline, mid-program, and post-program data for the same participants. Manual matching by name or email leads to duplicates and missing records. Persistent unique stakeholder IDs — assigned automatically at first contact — solve this by linking all data points across time, enabling true pre-post measurement without reconciliation.

Apply deadweight (what would have happened anyway), attribution (other contributors' share), displacement (negative effects shifted elsewhere), and drop-off (declining value over time) to reduce gross outcomes to credible net impact. Conduct sensitivity analysis varying each assumption to show the ratio holds under conservative conditions. Document every judgment transparently.

SROI adoption remains low because the traditional process requires specialized expertise, months of data cleanup, expensive consultants, and systems that cannot support continuous measurement. Many organizations attempt SROI once, find it unsustainable, and revert to simpler metrics. AI-native platforms make SROI practical by automating the heavy lifting — data cleaning, qualitative analysis, and report generation — enabling teams to focus on interpretation and learning.

SROI includes non-monetary social outcomes valued through stakeholder-informed proxies, while cost-benefit analysis considers only financial costs and benefits. SROI centers stakeholder voice in determining what outcomes matter; cost-benefit analysis is analyst-driven. SROI produces a social value ratio; CBA produces a net present value in dollars.

Yes — SROI is not limited to large organizations with evaluation budgets. The methodology scales based on scope and depth. Small organizations can start with a focused evaluative SROI covering their primary program and 2–3 key outcomes. AI-driven platforms reduce the cost and expertise required, making SROI accessible to organizations that previously considered it impractical.

Common proxy sources include government cost databases (avoided healthcare, criminal justice, or social service costs), labor market statistics (wage gains, employment rates), academic willingness-to-pay studies, and market replacement costs. The Global Value Exchange provides a searchable database. Always adjust proxies for local context and conduct sensitivity analysis.

SROI outcomes can be mapped to SDG indicators, providing a monetized view of how programs contribute to global development targets. For example, employment outcomes map to SDG 8 (Decent Work), health improvements to SDG 3 (Good Health), and education gains to SDG 4 (Quality Education). This mapping helps funders and governments track SDG progress using SROI data.

Traditional SROI is updated annually or semi-annually, but continuous approaches refresh automatically with each new stakeholder data submission. The optimal cadence depends on program length and data flow. Short-term programs (3–6 months) benefit from real-time updates; multi-year initiatives should review SROI quarterly at minimum, with continuous monitoring of leading indicators between reviews.