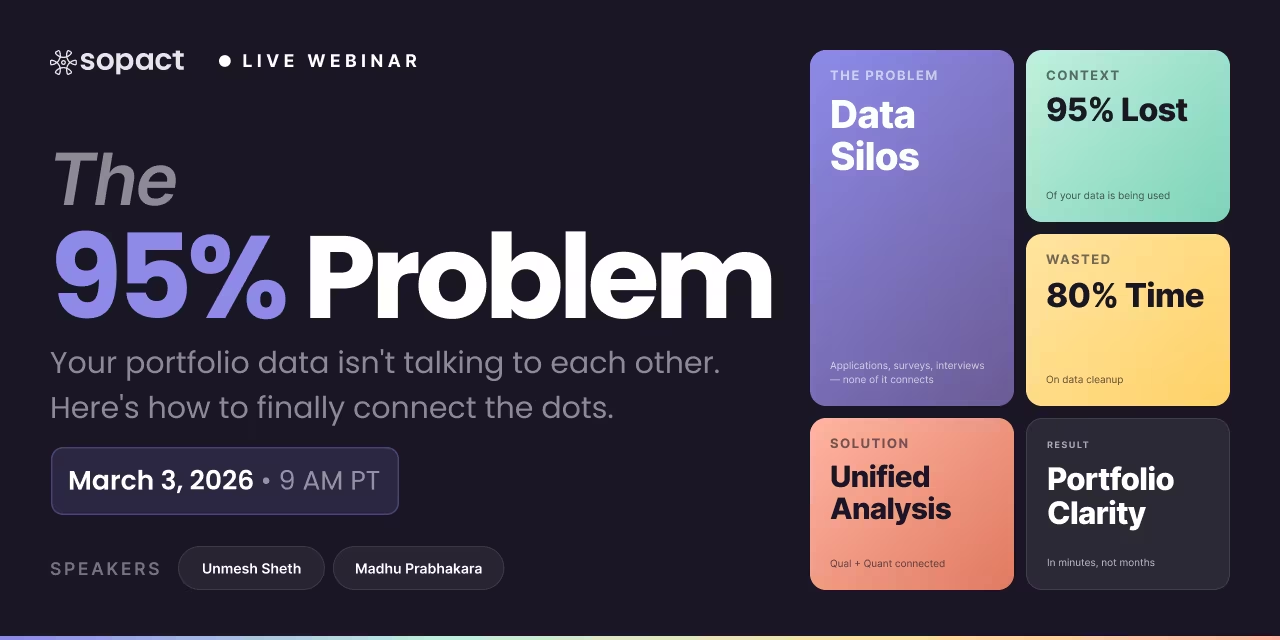

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Learn what venture philanthropy is, how it differs from traditional giving and impact investing, and how it creates measurable, lasting social change.

Traditional philanthropy operates on a simple premise: identify a problem, fund an organization addressing it, wait for an annual report, repeat.

This model worked reasonably well when charitable giving focused on direct service delivery—feeding people, sheltering families, providing medical care. But as the social sector matured and funders began expecting systemic change, the limitations became impossible to ignore.

Most foundation grants run for one to three years. This timeline forces nonprofits into constant fundraising mode rather than sustained implementation.

Organizations spend 30–40% of leadership time chasing the next grant instead of deepening program quality or expanding proven interventions. Every funding cycle restart means relationship rebuilding, proposal rewriting, and strategic pivoting to match the latest foundation priorities.

The result? Fragmented impact strategies that never reach the scale or duration required to shift underlying conditions.

The philanthropic sector's obsession with "low overhead" has crippled organizational effectiveness for decades.

Funders celebrate 90% program spending ratios while nonprofits struggle with outdated technology, understaffed finance teams, and burned-out leadership. This restriction is particularly absurd in an era where data management, stakeholder engagement, and adaptive learning are core drivers of impact.

You cannot achieve sustainable outcomes without investing in the systems that enable learning, adaptation, and resilience. Traditional philanthropy's overhead phobia directly contradicts this reality.

Most traditional grants include vague impact expectations and minimal accountability mechanisms.

Grantees submit narrative reports describing activities rather than outcomes. Funders lack the data infrastructure to aggregate learning across their portfolio. When interventions fail, neither party has sufficient evidence to understand why or how to improve.

This information vacuum means philanthropic capital cannot compound the way investment capital does—there's no systematic mechanism for deploying resources more effectively based on what worked previously.

Venture philanthropy emerged in the 1990s when successful entrepreneurs began applying their business experience to charitable giving.

The core insight was straightforward: if startups need more than money to succeed—they need mentorship, strategic guidance, network access, and patient capital—why would social purpose organizations be any different?

Venture philanthropy distinguishes itself through engagement intensity, time horizon, and support structure.

Long-term commitment: Investments typically span 5–10 years rather than 1–3 year grant cycles. This duration allows interventions to mature, leadership to stabilize, and impact to compound. Organizations can focus on execution rather than perpetual fundraising.

Operational partnership: Beyond capital, venture philanthropists provide strategic planning, talent recruitment, technology implementation, and measurement systems. This hands-on engagement accelerates organizational capacity faster than funding alone ever could.

Performance accountability: Clear milestones, regular data collection, and transparent impact reporting replace vague narratives. Both funder and grantee commit to evidence-informed adaptation—adjusting strategies based on what stakeholder data reveals rather than theoretical assumptions.

Traditional grants flow according to calendar schedules and foundation priorities.

Venture philanthropy structures capital around organizational readiness and growth trajectories. Early-stage organizations might receive smaller amounts paired with intensive capacity building. As execution strengthens and impact evidence accumulates, capital scales proportionally.

This approach mirrors how venture capital firms deploy capital across startup funding rounds—initial investments prove concepts, subsequent rounds scale what works.

The critical difference? Venture philanthropy success metrics center on stakeholder outcomes rather than financial returns. A workforce development organization succeeds when participants gain stable employment and wage growth, not when it generates investor profits.

Venture philanthropy's reliance on data separates it from both traditional philanthropy and conventional impact investing.

Impact investors often focus on enterprise-level metrics like revenue growth or beneficiary reach. Traditional funders accept anecdotal stories or output counts. Neither approach captures whether people's lives actually improved in meaningful, sustained ways.

Sopact Sense exemplifies the infrastructure required for genuine venture philanthropy practice. The platform enables organizations to collect clean stakeholder data from the start, track both quantitative and qualitative signals continuously, and analyze patterns across time periods to identify what's driving outcomes versus what's merely correlated noise.

This isn't monitoring and evaluation as compliance exercise. It's the operational foundation for learning faster than problems evolve—exactly what venture philanthropists require to justify long-term commitments and operational engagement.

Confusion between these three approaches wastes considerable energy in the social sector.

Let's establish clear boundaries so organizations can match their needs to the right capital source.

Impact investments target companies pursuing social or environmental missions while generating revenue sufficient to repay investors with interest or equity appreciation.

These are actual investments—capital providers expect their money back plus returns competitive with comparable risk profiles. The innovation lies in proving that mission-driven businesses can achieve financial performance while creating measurable stakeholder benefit.

Example: A community solar developer that installs renewable energy in low-income neighborhoods while maintaining margins that support debt repayment and investor returns operates in the impact investing space.

Venture philanthropy directs capital exclusively to nonprofit organizations where financial return is impossible by design.

Success is measured entirely through social outcomes—lives improved, systems shifted, problems solved. The "return" is impact evidence, not financial appreciation. This fundamental distinction means venture philanthropy can support interventions that would never attract commercial capital despite delivering enormous social value.

Example: A workforce training program serving formerly incarcerated individuals will never generate investor-grade returns, but venture philanthropy can fund its scale if stakeholder data demonstrates reliable employment outcomes.

Traditional grant-making provides capital with minimal operational involvement beyond compliance reporting.

This hands-off approach works for mature organizations executing well-understood interventions. It fails when organizations face capacity constraints, measurement challenges, or strategic uncertainty—which describes most nonprofits attempting ambitious impact goals.

The chart below clarifies when each approach makes sense:

Venture philanthropy isn't just longer grants with more meetings.

Effective practice requires structural commitments that reshape funder-grantee dynamics entirely.

Capital flows toward organizations demonstrating readiness to scale proven interventions rather than distributing funds broadly across numerous unproven approaches.

This concentration strategy contradicts traditional philanthropy's diversification instinct. Venture philanthropists argue that spreading resources thinly across hundreds of organizations ensures minimal impact from any single investment. Better to deploy significant capital behind fewer, higher-potential change agents.

Selection criteria emphasize leadership quality, measurement capability, stakeholder engagement, and evidence of traction. Organizations without these fundamentals receive capacity-building support first, investment capital second.

Funders commit resources beyond money—strategic planning, talent networks, technology systems, and measurement infrastructure.

This engagement model requires different funder capabilities than traditional grant-making. Venture philanthropy teams often include former nonprofit executives, management consultants, and data specialists who can provide genuinely useful operational guidance rather than superficial advice.

The partnership operates on mutual accountability. Grantees commit to transparent data sharing and strategic adaptation. Funders commit to sustained support even when challenges emerge, working through problems collaboratively rather than withdrawing capital at the first sign of difficulty.

Clear outcome goals, regular stakeholder data collection, and evidence-informed adaptation replace vague aspirations and annual narrative reports.

Effective measurement starts with stakeholder-centered questions: Whose lives are we trying to improve? What specific changes would constitute meaningful improvement? How will we know if we're succeeding?

Platforms like Sopact Sense enable this rigor without administrative burden. Organizations collect data continuously through integrated surveys, interviews, and document analysis. AI-powered tools like Intelligent Cell extract themes from qualitative responses, Intelligent Row summarizes individual participant journeys, and Intelligent Column identifies patterns across cohorts.

This infrastructure turns measurement from compliance exercise into strategic asset—organizations learn faster, adapt better, and demonstrate impact more credibly than competitors stuck in annual evaluation cycles.

Venture philanthropists actively connect portfolio organizations, share learning across investments, and coordinate with complementary funders to maximize collective impact.

This network approach acknowledges that complex social problems require multi-organization solutions. Rather than treating grantees as isolated competitors, venture philanthropy builds collaborative infrastructure where organizations learn from each other's successes and failures.

Example: The European Venture Philanthropy Association convenes nearly 300 member organizations, facilitating knowledge exchange and coordinated funding strategies that amplify individual investments.

Interventions target root causes and systemic barriers rather than symptoms alone.

This principle separates venture philanthropy from both traditional charity (which often provides temporary relief) and some impact investing (which may optimize within broken systems rather than fixing them).

Systems change requires longer time horizons, tolerance for strategic experimentation, and willingness to engage power structures. Venture philanthropy's multi-year commitments and operational support make this approach viable where short-term grants cannot.

The clearest evidence of venture philanthropy's value appears in organizations that transition from survival mode to sustainable impact.

Traditional grant recipients spend enormous energy on resource acquisition—writing proposals, cultivating donors, managing restricted funds with incompatible reporting requirements. This constant scrambling prevents the focused execution required for meaningful outcomes.

Venture philanthropy's long-term commitments and flexible funding liberate leadership attention.

Organizations cannot expand proven interventions without systems that support growth.

Technology infrastructure tops this list. Most nonprofits operate on outdated donor databases, manual spreadsheets, and fragmented communication tools. This technical debt creates bottlenecks that prevent scale regardless of capital availability.

Venture philanthropists fund the Salesforce implementations, custom data platforms, and integrated communication systems that commercial businesses consider baseline requirements. The investment seems like overhead until you recognize that reaching 10x more people requires infrastructure that supports 10x operations.

Sopact Sense exemplifies infrastructure investment that compounds over time. Organizations start by centralizing stakeholder data through unique contact IDs that eliminate duplication and enable longitudinal tracking. As programs mature, they layer on AI-powered analysis that surfaces insights no human could extract from thousands of qualitative responses.

This capacity becomes permanent—subsequent programs inherit robust measurement systems rather than building from scratch every time.

Nonprofit executive turnover wastes institutional knowledge and derails strategic momentum.

Venture philanthropists address this through competitive compensation packages, executive coaching, and peer learning networks. Treating talented leaders as the scarce resource they are—rather than expecting mission-driven martyrdom—produces better outcomes for everyone involved.

When the Jewish Venture Philanthropy Fund invested over $20 million across 50+ Israeli nonprofits, their emphasis on leadership support proved as valuable as capital. Organizations stabilized, strategic plans extended beyond survival thinking, and impact evidence improved measurably.

Traditional evaluation happens too late and too infrequently to inform real-time decision-making.

Venture philanthropy embeds measurement into operations—collecting stakeholder feedback continuously, analyzing patterns as they emerge, and adapting strategies based on what data reveals about program effectiveness.

This requires different tools than annual surveys or external evaluations. Organizations need lightweight data collection that doesn't burden staff, qualitative analysis at scale (impossible manually), and dashboards that surface actionable insights rather than overwhelming teams with statistics.

The Intelligent Suite within Sopact Sense demonstrates what becomes possible when measurement infrastructure matches operational needs. Intelligent Cell analyzes individual documents or responses, extracting sentiment, themes, or rubric scores. Intelligent Row summarizes entire participant journeys across multiple data points. Intelligent Column identifies patterns across cohorts or time periods. Intelligent Grid generates complete impact reports from plain-English prompts.

This infrastructure enables organizations to ask and answer questions like: Which program components correlate most strongly with positive outcomes? Do participant experiences differ across demographic groups? Has our theory of change held up against real-world implementation?

Organizations with this capability improve faster than competitors relying on intuition and anecdote.

Organizations structure venture philanthropy practice in several ways, each with distinct advantages.

Some venture philanthropists structure capital deployment around verified outcome achievement rather than activity milestones.

This approach most closely resembles Social Impact Bonds or Development Impact Bonds—investors provide upfront capital, implementers execute programs, independent evaluators verify outcomes, and outcome payors (often governments or foundations) repay investors based on success.

The Robert Enterprise Development Fund pioneered this model using Social Return on Investment (SROI) frameworks that monetize outcomes like employment gains, recidivism reduction, or health improvements. By assigning dollar values to impacts, SROI enables direct comparison of program cost-effectiveness.

This transparency appeals to outcome-focused funders who want assurance their capital produces measurable results rather than merely supporting organizational operations.

Other venture philanthropists emphasize hands-on operational support over financial structures.

New Profit, founded in 1998, exemplifies this model. They invest in promising social entrepreneurs for 5–10 year partnerships, providing strategic planning, talent recruitment, fund development, and measurement systems alongside capital. This intensive engagement accelerates organizational capacity faster than funding alone.

The model requires significant funder capacity—New Profit maintains teams of former nonprofit executives and management consultants who provide genuinely useful operational guidance. This approach works best for funders willing to invest in internal capabilities rather than outsourcing due diligence and monitoring.

Giving circles aggregate capital from multiple high-net-worth individuals or foundations, then deploy collective resources strategically.

Social Venture Partners (SVP), founded in 1997, pioneered this approach with 40+ partner affiliates worldwide. SVP combines financial contributions with volunteer capacity building—partners contribute both money and professional expertise to support portfolio organizations.

This model democratizes venture philanthropy access. Individual donors who couldn't deploy $5–10 million investments independently can participate in collective funds with similar engagement intensity and impact focus.

Some organizations blend nonprofit and for-profit vehicles to maximize flexibility.

The Omidyar Network operates both a 501(c)3 foundation making grants and an LLC making investments. This structure enables support for nonprofits pursuing purely charitable missions alongside revenue-generating social enterprises that need patient capital rather than grants.

The Skoll Foundation takes a similarly diversified approach through program-related investments, grant-making, and ecosystem-building initiatives that strengthen venture philanthropy practice globally.

These hybrid models work best for large funders comfortable managing complex structures and willing to invest in specialized legal and operational infrastructure.

Abstract discussions about models matter less than concrete examples of lives changed.

The Mulago Foundation invests in scalable solutions to poverty, focusing ruthlessly on cost-effectiveness per life impacted.

In Uganda, they identified rainwater harvesting as a high-leverage intervention. Rural communities lacked reliable water access, forcing women and children to spend hours daily collecting from distant, often contaminated sources.

Rather than funding traditional well-digging (expensive, requires ongoing maintenance), Mulago invested in organizations distributing rooftop rainwater collection systems. These simple technologies capture rainfall during wet seasons, storing water for dry periods.

The venture philanthropy approach showed up in several ways:

Long-term commitment: 7-year partnership allowing the implementer to refine distribution models and build local maintenance capacity.

Operational support: Help developing supply chains, training installers, and creating payment models affordable for low-income families.

Rigorous measurement: Tracking not just systems installed but actual household water quality, time savings for women, and health improvements in children.

Results: Over 100,000 households gained reliable clean water access. Women reported 6–8 hours weekly time savings, enabling income-generating activities or children's education support. Child diarrheal disease rates declined 40–60% in participating communities.

The intervention cost roughly $50 per household for infrastructure that lasts 15–20 years—dramatically more cost-effective than alternatives like trucked water or deep boreholes.

JVPF, founded in 2000, invested $20+ million across 50+ Israeli nonprofits addressing education, employment, healthcare, and inclusion.

Their approach combined flexible, multi-year funding with intensive capacity building. Portfolio organizations received:

The transformation showed up clearly in organizational sustainability. Before JVPF engagement, portfolio organizations averaged 18 months runway and 30% annual executive turnover. After 5 years of partnership, median runway increased to 36 months and turnover dropped to 12%.

Impact outcomes improved proportionally. Youth employment programs showed 40% better job placement and 12-month retention rates compared to traditional grant recipients. Healthcare access initiatives expanded from serving 5,000 to 50,000+ underserved patients annually while maintaining quality metrics.

The investment demonstrated that organizational capacity often constrains impact more than funding scarcity—addressing capacity first enables existing resources to generate far better outcomes.

Sometimes venture philanthropy's power appears most clearly in collaborative funding models.

UK-based Impetus partnered with Charities Aid Foundation to support Naz Project London (NPL), addressing HIV prevention and sexual health in South Asian communities—a population traditionally underserved by mainstream healthcare.

The joint investment included:

Results: NPL quadrupled service reach from 1,500 to 6,000+ annual participants. HIV testing rates in target communities increased 300%. Perhaps most importantly, community trust and engagement improved dramatically—participants referred family members and friends, indicating genuine value rather than reluctant compliance.

The venture philanthropy approach proved essential because NPL's work required cultural sensitivity and community relationship building that takes years to develop. Traditional 1–3 year grants would have forced constant disruption and strategy shifts. The long-term commitment enabled deep community integration that short-term funding never achieves.

Wealth distribution is shifting dramatically, and so are giving patterns.

Over $68 trillion will transfer from Baby Boomers to Millennials and Gen X over the next 25 years—the largest intergenerational wealth transfer in history.

Younger wealth holders show markedly different philanthropic priorities. According to Deloitte research, nearly 30% of Millennials believe improving society should be business's top priority—higher than profit maximization or shareholder returns.

These values translate into giving behavior. Millennial millionaires donate 40% more annually than their Boomer counterparts, averaging $30,000+ in contributions versus $6,000 for older generations. More significantly, they demand measurable outcomes and operational transparency that traditional philanthropy rarely provided.

This generational shift creates tailwinds for venture philanthropy. Younger donors want engagement beyond check-writing—they seek partnership, data-informed decision-making, and evidence their capital generates real change. Venture philanthropy's intensive engagement model fits this preference perfectly.

By 2030, women will control nearly two-thirds of private wealth in the United States.

Female philanthropists and advisors show systematically higher interest in sustainable investing and outcomes measurement. Research indicates 59% of female wealth advisors prioritize sustainable investment funds compared to 34% of male counterparts.

This preference extends beyond ESG screening to genuine impact focus. Women-led family offices more frequently ask rigorous questions about stakeholder outcomes, community benefit, and long-term sustainability—precisely the questions venture philanthropy is designed to answer.

The combination of generational transfer and gender dynamics means the donor base most receptive to venture philanthropy principles is growing rapidly while traditional philanthropy's core constituency ages out.

Donor-Advised Funds (DAFs) have grown explosively, now holding over $230 billion in US charitable assets.

These vehicles let donors make irrevocable charitable contributions, receive immediate tax deductions, and recommend grants over time. DAF sponsors traditionally offered minimal guidance beyond listing eligible nonprofits.

That's changing. Leading DAF sponsors now provide strategic giving frameworks, impact measurement support, and connections to high-performing organizations. Some facilitate venture philanthropy-style engagement by connecting multiple donors around shared priorities, enabling collaborative funding with the engagement intensity individual donors couldn't achieve alone.

Fidelity Charitable, Schwab Charitable, and specialized DAF sponsors like ImpactAssets increasingly position themselves as venture philanthropy enablers rather than passive grant processors.

This evolution democratizes venture philanthropy access—donors without $10+ million to deploy independently can participate in collaborative funds achieving similar engagement and impact focus.

Venture philanthropy isn't a panacea, and honest practice acknowledges ongoing tensions.

Intensive funder engagement risks crossing from partnership into interference.

Nonprofits with successful track records justifiably resent funders who micromanage operations or impose strategic priorities disconnected from community needs. Venture philanthropists must calibrate involvement carefully—providing useful support without undermining grantee agency.

The best partnerships establish clear boundaries upfront. Funders commit to specific support areas (e.g., technology, measurement, talent recruitment) while explicitly affirming grantee control over mission, strategy, and community engagement.

Regular check-ins assess whether the partnership is genuinely useful or creating administrative burden disguised as support.

Rigorous outcome tracking requires data collection discipline that can burden small organizations.

The solution isn't retreating to vague narratives—it's investing in measurement infrastructure that makes data collection lightweight and analysis automatic. This is precisely why platforms like Sopact Sense matter for venture philanthropy's viability at scale.

Organizations shouldn't spend 20% of staff time on measurement. They should collect stakeholder data continuously through embedded workflows, then rely on AI-powered analysis to surface insights without manual labor.

When measurement infrastructure works properly, it reduces burden rather than increasing it—providing real-time insights that improve decision-making faster than annual external evaluations ever could.

Multi-year funding creates genuine partnership but risks making organizations dependent on single funders.

Thoughtful venture philanthropists build exit strategies from the start. The goal is strengthening organizations until they can attract diverse funding, generate earned revenue, or otherwise reduce reliance on the initial venture philanthropy relationship.

This requires honest conversations about sustainability from day one. What does organizational readiness look like? Which capabilities must be built before the funder steps back? How will we know when the partnership should transition or end?

Organizations that treat venture philanthropy as permanent solution rather than capacity-building bridge often find themselves unprepared when funders rotate focus to other priorities.

Venture philanthropy's high engagement enables support for innovative, unproven approaches that traditional funders avoid.

But innovation without evidence risks wasting resources on interventions that sound compelling but don't actually work. The tension between supporting experimentation and demanding proof requires careful navigation.

Best practice: Structure partnerships with explicit learning agendas. Early stages emphasize rapid iteration and stakeholder feedback over proving impact at scale. As models mature and evidence accumulates, accountability shifts toward demonstrating outcomes that justify continued investment.

This staged approach—common in venture capital where early rounds fund product development and later rounds scale proven traction—transfers naturally to venture philanthropy.

Venture philanthropy is evolving from niche practice to mainstream expectation.

The boundary between philanthropy and impact investing is blurring.

Sophisticated funders now deploy blended capital stacks—grants for capacity building, concessionary debt for working capital, near-market equity for scale. This flexibility matches capital instruments to organizational needs and risk profiles rather than forcing every situation into either grant or investment categories.

Development finance institutions like OPIC and bilateral agencies have pioneered this approach internationally. Now family offices and foundations are applying similar thinking domestically, recognizing that social purpose organizations need diverse capital types across their lifecycle.

Pooled outcomes payor vehicles are enabling venture philanthropy to operate at ecosystem scale.

Instead of individual funders negotiating separate performance contracts, outcomes funds commit to paying for verified results regardless of which implementer achieves them. This structure lets multiple organizations compete to deliver outcomes while investors cover upfront costs.

The UK's Life Chances Fund, Colombia's employment outcomes fund, and the Education Outcomes Fund demonstrate this model's potential. As outcomes verification becomes more reliable (partly through better measurement infrastructure), these pooled vehicles will proliferate.

Artificial intelligence is transforming how venture philanthropists analyze portfolio performance and identify promising investments.

Platforms like Sopact Sense enable portfolio-wide analysis previously impossible. Funders can ask questions like: Which program components correlate most strongly with positive outcomes across all investments? Do theories of change validated in one geography translate to others? How do outcomes vary based on leadership experience, community engagement intensity, or measurement rigor?

This systematic learning compounds over time. Each investment generates data that improves subsequent allocation decisions, creating feedback loops where capital flows increasingly toward what works rather than what sounds appealing.

As venture philanthropy matures, field-building organizations are establishing shared standards.

The European Venture Philanthropy Association, GIIN's IRIS+ framework, and the UN SDG Impact Standards provide common vocabularies and measurement approaches. This standardization enables comparison across portfolios and aggregation of learning across the sector.

Transparency is increasing too. Leading venture philanthropists now publish detailed portfolio data, impact methodology, and failure analyses—recognizing that field-level learning matters more than protecting individual organizational reputation.

This openness accelerates improvement across the entire sector, benefiting both funders and the communities they aim to serve.

Individual funder excellence matters less than ecosystem-level capability.

The sector's greatest constraint isn't capital availability—it's the operational infrastructure required to deploy capital effectively at scale.

Traditional philanthropy lacks feedback loops that translate past experience into improved future decisions.

Each funder operates independently, using idiosyncratic measurement approaches and proprietary data systems. When interventions succeed or fail, learning rarely transfers beyond the original partnership. The sector repeats mistakes and reinvents solutions rather than building collective intelligence.

Sopact Sense and similar platforms create infrastructure for systematic learning. Standardized metrics (using frameworks like IRIS+) enable comparison across organizations and time periods. Portfolio-wide analysis surfaces patterns—which program components correlate with outcomes, how effects differ across populations, what capacity-building investments generate strongest returns.

This data infrastructure transforms venture philanthropy from craft to discipline. Capital flows toward what evidence proves works rather than what intuition or relationships suggest.

Effective venture philanthropy requires sophisticated practitioners who combine funding knowledge, nonprofit operational experience, and data literacy.

Organizations like EVPA, Philanthropy New York, and regional associations are building professional development pathways. Workshops, peer learning cohorts, and structured training programs help funders develop the strategic planning, measurement design, and partnership management skills that venture philanthropy demands.

As talent pipelines strengthen, practice quality improves across the sector. More funders can provide genuinely useful operational support rather than well-intentioned but impractical advice.

Regulatory structures are evolving to accommodate venture philanthropy's hybrid characteristics.

US foundations can now make Program-Related Investments (PRIs) that count toward minimum payout requirements while accepting below-market returns. This flexibility enables venture philanthropy approaches that blend grants and investment structures.

Donor-Advised Funds have expanded eligible activities, letting account holders participate in impact investments alongside traditional grants. While restrictions remain (DAFs still can't invest in for-profits from charitable balances), the direction is clearly toward greater flexibility.

These structural changes remove barriers that previously forced funders to choose between charitable effectiveness and regulatory compliance.

Theory matters less than implementation. Here's how to engage with venture philanthropy practice.

Assess your readiness: Venture philanthropy requires long-term commitment and operational capacity. Can you commit 5–10 years to partnerships? Do you have staff capable of providing useful non-financial support?

Start small, learn fast: Begin with one or two high-engagement partnerships rather than converting your entire portfolio immediately. Document what works, what doesn't, and how to improve.

Invest in infrastructure: Measurement systems, data platforms, and strategic planning capabilities matter as much as grant dollars. Budget for the operational support that separates venture philanthropy from traditional grant-making.

Join learning networks: Organizations like EVPA, SVP, and regional associations provide training, peer learning, and field-building resources that accelerate your practice development.

Expect measurement, provide tools: Require rigorous outcome tracking from partners, then invest in platforms like Sopact Sense that make measurement lightweight and actionable.

Build measurement capability first: Organizations without credible impact evidence can't attract venture philanthropy. Invest in stakeholder data systems, outcome tracking, and learning infrastructure before approaching venture philanthropists.

Develop clear scale plans: Venture philanthropists want to know how your intervention could reach 10x or 100x more people. If you can't articulate this path, you're not ready for growth capital.

Strengthen leadership and governance: Executive quality and board engagement matter enormously. Invest in professional development, succession planning, and strategic governance that inspires funder confidence.

Be honest about capacity needs: Don't pretend operational excellence you haven't achieved. Venture philanthropists want partners honest about constraints who will actively engage with capacity-building support.

Prepare for partnership intensity: Venture philanthropy requires transparency, regular communication, and openness to strategic advice. Organizations unprepared for this engagement level should seek traditional grants instead.

Venture philanthropy solves a problem that traditional philanthropy cannot: the persistent gap between funding availability and organizational capacity to generate sustainable impact.

Nonprofits don't fail for lack of mission commitment or strategy intelligence. They fail because fragmented, short-term funding creates operational chaos that prevents effective execution. Leaders spend energy chasing grants rather than deepening programs. Organizations invest in activity reporting rather than outcome improvement. Impact evidence remains anecdotal because measurement infrastructure requires sustained investment that annual grants never provide.

Venture philanthropy breaks this cycle through commitment, partnership, and data. Long-term funding liberates leadership attention. Hands-on operational support accelerates capacity building. Rigorous measurement enables continuous improvement rather than annual evaluation theater.

The approach isn't appropriate for every situation. Mature organizations executing proven models may need only financial resources without intensive engagement. Early-stage experiments may require exploratory grants before they're ready for performance accountability. But for growth-stage nonprofits ready to scale impact—venture philanthropy offers advantages traditional grant-making simply cannot match.

As wealth transfers to younger, more outcomes-focused donors, and as measurement infrastructure becomes more sophisticated through platforms like Sopact Sense, venture philanthropy will likely shift from alternative approach to mainstream expectation. Funders will increasingly demand evidence, partnership, and continuous learning as standard practice rather than exceptional commitment.

This evolution benefits everyone. Philanthropists gain confidence their resources generate measurable change. Nonprofits build capacity that persists beyond any single funding relationship. Most importantly, the communities these organizations serve experience better outcomes because interventions improve faster through systematic, data-informed learning.

The future of effective philanthropy is venture philanthropy—strategic, engaged, evidence-driven partnership that treats social change as seriously as business investors treat commercial ventures.

From Months of Manual Analysis to Minutes of Insight

Sopact's Intelligent Suite transforms how venture philanthropy organizations measure, manage, and improve impact across their portfolios

Analyze specific documents, survey responses, or interview transcripts to extract themes, sentiment, rubric scores, or custom frameworks. Perfect for processing grant applications, outcome surveys, or stakeholder interviews at scale.

Example: Process 200 program exit interviews to extract confidence levels, skill gains, and employment readiness scores—work that previously required weeks of manual coding completed in minutes.Generate plain-language summaries of individual stakeholders by synthesizing all data points across surveys, documents, and interactions. Ideal for investment committee reviews, impact stories, or identifying participants needing additional support.

Example: Review 50 scholarship applicants by getting AI-generated summaries that synthesize application essays, recommendation letters, and financial documents—enabling faster, more consistent decision-making.Analyze entire columns of data to surface trends, correlations, and insights across your portfolio. Answers questions like "What themes appear most frequently in participant feedback?" or "How do outcomes differ between program models?"

Example: Compare confidence levels across pre/mid/post surveys for 300 workforce training participants, automatically identifying which program components correlate with greatest improvement.Create portfolio-wide impact reports by typing plain-English instructions. Grid synthesizes quantitative metrics, qualitative themes, and cross-sectional analysis into designer-quality reports ready to share with boards, investors, or the public.

Example: Generate a complete portfolio impact report covering 10 organizations, 5,000 participants, and 3 years of data—from prompt to shareable link in under 5 minutes.The transformation: What once required external evaluators, months of delays, and tens of thousands in consulting fees now happens continuously in-house. Venture philanthropy organizations gain the evidence they need to support portfolio companies, demonstrate results to donors, and improve strategies based on stakeholder data rather than assumptions.