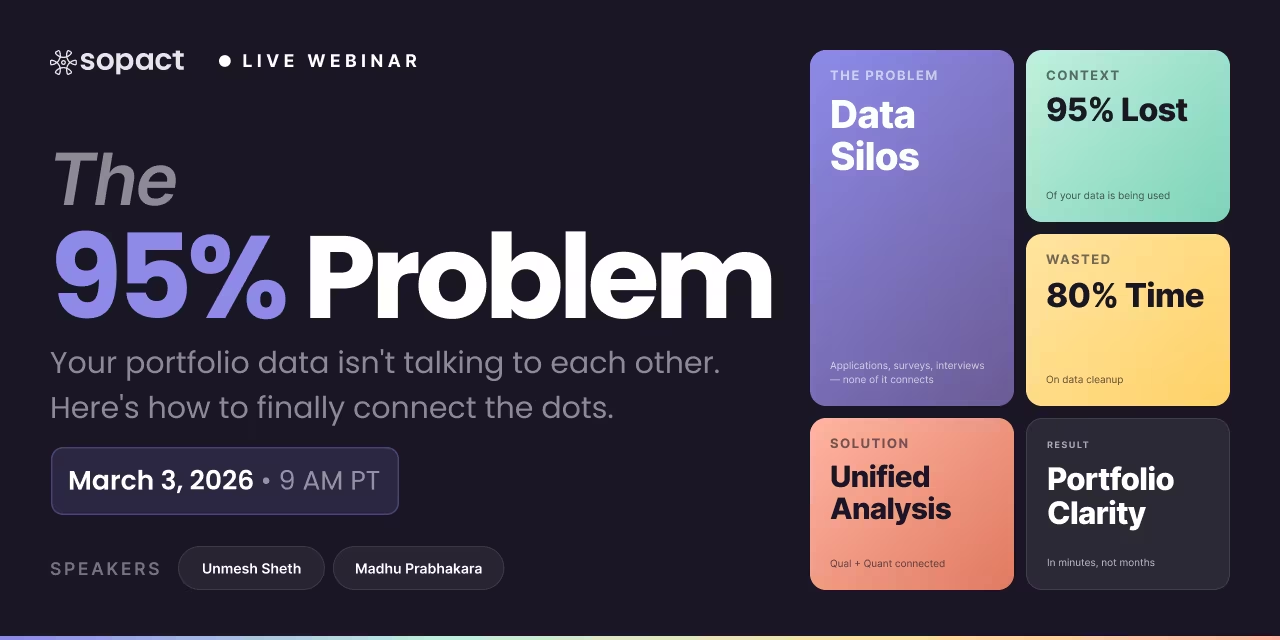

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Learn secondary data analysis methods that transform census records, research papers, and internal reports into program insights without costly new.

Author: Unmesh Sheth

Last Updated:

February 13, 2026

Founder & CEO of Sopact with 35 years of experience in data systems and AI

Most teams collect new data when the answers already exist in what they've gathered before.

Secondary data sits in your files right now—internal reports, public records, research archives—waiting to reveal patterns you've been searching for. It's information someone already collected, whether that's your organization tracking participant outcomes over five years or government agencies publishing census datasets.

Secondary data is information collected by someone else for a different original purpose, now repurposed to answer new questions without starting data collection from scratch.

This matters because organizations waste months designing surveys and interviews to answer questions that existing datasets could resolve in days. Budget constraints, time pressure, and resource limitations make secondary data not just convenient—but strategic. When your evaluation deadline is three weeks away and you need baseline community demographics, secondary data from census records provides immediate context that would take months to gather firsthand.

How to identify high-quality secondary data sources that match your evaluation needs, including internal organizational records and external public datasets.

Methods for analyzing secondary data that transform scattered information into clear evidence for program decisions and impact reporting.

Best practices for evaluating data quality, ensuring reliability, and addressing the limitations inherent in using information collected for different purposes.

Specific techniques for combining secondary data with primary data collection in Sopact Sense, creating integrated analyses that show both what happened and why it matters.

Strategic approaches for nonprofit teams to leverage existing data without expensive new collection efforts, reducing time-to-insight from months to minutes.

Most organizations treat data collection as starting fresh every time. Let's explore why the most valuable information might already be sitting in your systems, public records, and research archives—and how to put it to work.

Understanding which approach fits different evaluation scenarios

Strategic Integration: The most rigorous evaluations combine both approaches—secondary data establishes context and baselines, while primary data captures program-specific experiences and outcomes that external sources can't provide.

Traditional approach: Download census data → Export to Excel → Build comparison tables → Create charts → Weeks of work.

Sopact Sense approach: Upload data → Type instructions in plain English → Generate analysis → Minutes of work.

Practitioners ask these questions when evaluating whether secondary data fits their evaluation needs.

Secondary data is information collected by someone else for a different original purpose, now repurposed to answer new questions. Primary data is information you collect directly for your specific evaluation needs. The key difference isn't who collected it—even your own organizational records become secondary data when you analyze them for purposes beyond their original collection intent.

Example: If you collected participant feedback to improve program delivery, then later analyze that same feedback to measure outcome trends, you're conducting secondary analysis of your own data.Four sources consistently prove most useful: internal organizational records (attendance, surveys, intake data), government datasets (census demographics, employment statistics, health indicators), published research studies evaluating similar programs, and sector reports from foundations or nonprofit networks. Internal records are often overlooked but provide immediate historical context without external dependencies.

Start with what you already have—your own accumulated program data—before searching external sources.Evaluate four quality dimensions: source credibility (government agencies and peer-reviewed research typically maintain higher standards), recency (data older than 3-5 years may not reflect current conditions), relevance (does it actually match your population and context), and completeness (sufficient sample sizes and minimal missing data). Always check the original collection methodology before trusting conclusions.

Strong secondary data includes transparent documentation about collection methods, sample characteristics, and known limitations.Yes, and this integration produces the strongest evaluations. Use secondary data to establish context and baselines—community demographics, sector benchmarks, historical trends. Then focus primary data collection on gaps that secondary sources can't fill—specific participant experiences, program-specific outcomes, detailed implementation insights. This approach reduces collection burden while increasing analytical depth.

Three frequent errors undermine secondary data analysis: assuming definitions match yours without verification (census "poverty" calculations may differ from your assessment criteria), using outdated information as current truth (public data often lags 2-3 years), and overgeneralizing from narrow research contexts (results from urban youth programs may not apply to rural adult services). Always document the original context and acknowledge limitations explicitly.

Sopact Sense eliminates manual data processing steps through Intelligent Suite. Upload secondary sources—PDFs, government datasets, research papers—and use plain English instructions to extract insights, create comparisons, or generate reports. Intelligent Cell processes qualitative documents, Intelligent Column analyzes patterns across variables, and Intelligent Grid combines multiple sources into comprehensive analysis. What traditionally required spreadsheet formulas and statistical software now happens through natural language instructions.

Organizations report reducing secondary data analysis from days to minutes using AI-powered processing instead of manual extraction.

Five Steps for Rigorous Secondary Data Analysis

Follow this systematic approach to extract reliable insights from existing data sources.

Define Your Specific Question Before Searching Data

Start with a precise question that specifies population, geography, timeframe, and metric. Vague questions like "What's happening in our community?" lead to unfocused data searches. Strong questions like "Have unemployment rates among young adults in our service area changed in the past three years?" immediately point to specific data sources.

Weak questions produce data collections. Strong questions produce analyzable evidence.Locate Sources and Evaluate Quality Systematically

Apply four quality filters to every potential secondary source: credibility (government agencies and peer-reviewed research maintain higher standards), recency (data older than 3-5 years may not reflect current conditions), relevance (does it match your context and population), and completeness (sufficient sample sizes with minimal gaps).

Structure Data for Analysis, Not Just Reading

Transform unstructured information into analyzable formats. Download census tables as CSVs, not screenshots. Extract research findings into structured comparison tables showing sample sizes, interventions, and outcomes. Consolidate fragmented internal records into unified datasets with consistent variables across time periods.

Analysis happens on structured data. Reading happens on PDFs. Make the conversion explicit.Apply Analytical Methods Appropriate to Your Data Type

For quantitative secondary data: calculate descriptive statistics, identify trends over time, compare subgroups, test correlations between variables. For qualitative secondary data: identify recurring themes across sources, extract representative quotes, note contradictions, compare findings between different published studies. Use Intelligent Column in Sopact Sense to process both types simultaneously.

Document Limitations Explicitly in All Findings

Every secondary data analysis has constraints. Name them clearly rather than hiding them: original purpose mismatch (data tracked X but you need Y), definition differences (source defines terms differently than your needs), time lag (most recent data is 2+ years old). Explicit limitations establish appropriate confidence levels for decisions without invalidating the analysis.

Acknowledging limitations increases credibility. Ignoring them undermines trust when discovered later.