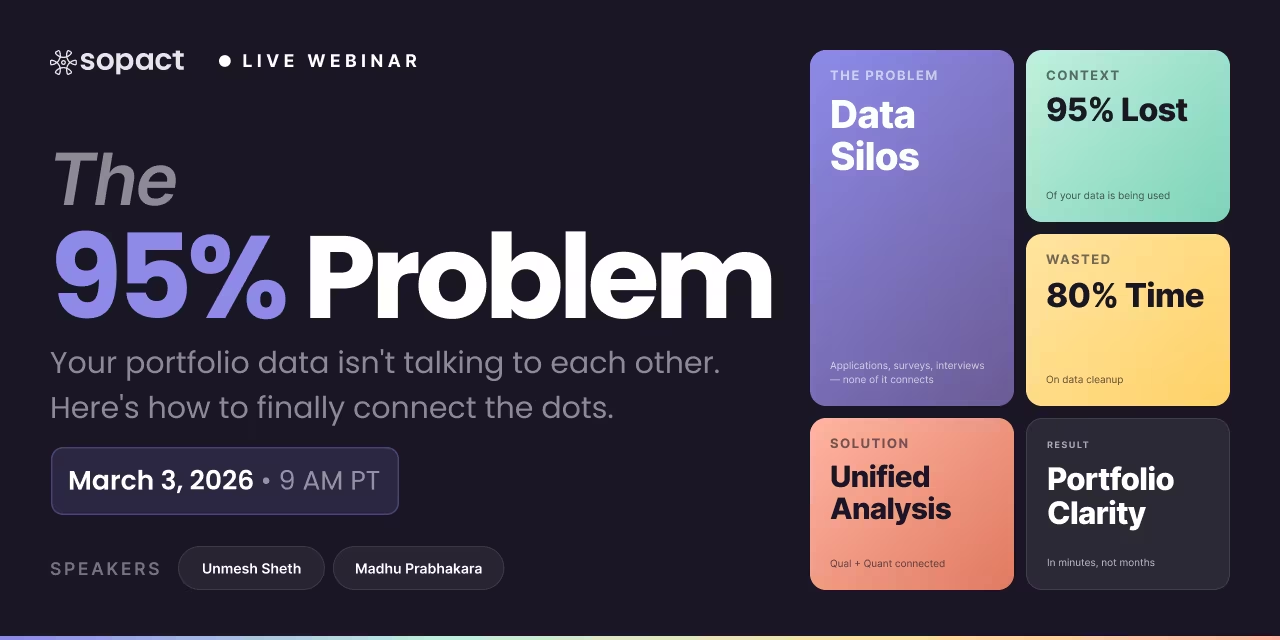

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Master pre and post survey design with real examples. Learn how to link baseline data to outcomes, analyze change over time, and prove program impact in minutes

A survey in January. An interview in April. A report in December.

Three data points. Zero connection between them.

When a funder asks, "Did your program actually make a difference?"—you're left guessing.

This is the fundamental problem with how most organizations approach pre and post surveys. They collect baseline data. They collect outcome data. But they never connect the two in ways that reveal why change happened, which participants benefited most, and what program elements actually drove results.

The matching problem alone defeats most efforts. Your pre survey says "Sarah Johnson" at one email address. Your post survey says "S. Johnson" at a different email. Same person? Maybe. Maybe not. That interview you conducted in month three? It sits in a separate folder, completely disconnected from your survey data.

Cross-sectional data shows you a moment. It doesn't show you change. And change is exactly what funders want to see.

A pre and post survey is an evaluation method that measures change by administering the same questions at two distinct timepoints. The pre survey (also called pre assessment, baseline survey, or pre-test) captures participants' starting conditions before a program begins. The post survey (also called post assessment or post-test) collects identical data after the program ends, revealing what shifted and why.

This approach forms the foundation of program evaluation because it establishes causation—not just correlation. When you measure the same individuals before and after your intervention, you can attribute change to your program rather than external factors.

The key distinction between pre and post surveys and other evaluation methods lies in participant matching. Unlike satisfaction surveys that capture a single snapshot, pre and post surveys track the same individuals over time. This longitudinal tracking enables you to answer questions like: Did participant confidence actually increase from month one to month six? Which program activities correlate with the biggest skill gains? Are early improvements sustained, or do they fade?

A pre survey—also called a pre assessment, baseline survey, or pre-test survey—is administered before a program starts. The pre assessment establishes starting conditions and captures current skills or knowledge levels, baseline confidence or readiness ratings, and anticipated barriers participants expect to face.

Every pre survey should use clear, consistent wording that will be repeated exactly in the post survey. The pre survey meaning centers on establishing a measurable starting point against which all future change is compared.

A post survey—also called a post assessment or post-test—is administered after a program ends. The post assessment uses the same questions as the pre survey to reveal skill gains or knowledge improvement, changes in confidence or readiness, and key drivers that influenced outcomes through qualitative feedback.

The post survey meaning refers to outcome measurement—capturing what changed between baseline and follow-up. Effective post survey design maintains identical scales and wording from the pre assessment to ensure valid comparison.

Traditional pre post survey analysis arrives too late to help current participants. Here's what typically happens:

6-8 weeks spent on manual data cleaning—deduplicating records, reformatting spreadsheets, reconciling mismatched participant IDs across separate tools.

4-6 weeks running basic statistical tests—calculating averages, running t-tests, producing charts that show aggregate change without explaining what drove it.

8-12 weeks coding qualitative data manually—reading through open-ended responses, creating theme codes, counting frequency, losing context in the process.

By the time insights arrive—often 5-7 months after data collection—the program has moved on. Current participants receive no benefit from what you learned. Funders get retrospective reports that prove change happened without revealing how to replicate it.

The core problems fall into three categories.

Problem 1: The Matching Problem

People change email addresses. They spell their names differently. They use nicknames. Most organizations try one of two approaches: they ask participants to remember a code (nobody remembers the code), or they try to match manually after the fact (this takes forever and introduces errors). The result is messy data, broken connections, and outcomes you can't actually prove.

Problem 2: Siloed Data

Pre survey data lives in one tool. Post survey data lives in another. Interview transcripts sit in separate files. When analysis time arrives, someone spends weeks reconciling formats, hunting for duplicates, and building lookup tables that still miss connections.

Problem 3: Qualitative-Quantitative Disconnect

Numbers tell you what changed. Open-ended responses tell you why. But traditional analysis treats these as separate reports. Stakeholders must connect the dots themselves, losing the narrative that makes data actionable.

The following pre and post survey examples demonstrate how pre assessment and post assessment work together to measure program impact. Each example shows actual pre survey questions, matching post survey questions, and the actionable insights organizations gained from analyzing both timepoints together.

Good pre and post survey analysis starts with good survey design. These principles ensure your baseline survey and post assessment collect clean, analysis-ready data from day one.

Pre and post surveys must use the exact same questions, response scales, and order. Even minor wording changes break comparability. If your pre survey asks about "confidence" and your post survey asks about "self-assurance," you've invalidated the comparison.

Lock your baseline survey structure before launch. Version any changes and document them. Never silently modify wording mid-cycle.

Long surveys depress completion rates and increase satisficing (respondents clicking through without reading). If you can't complete your survey in 6 minutes on a mobile device, cut questions.

Every item should map to a specific decision or action. If you won't analyze a question or use its results, remove it.

Use stable, unique identifiers to link pre and post responses. Email addresses change. Names get spelled differently. Phone numbers update.

Without clean identity management, you can't track individual change—only aggregate statistics. Aggregate statistics hide who benefited, who didn't, and why outcomes varied.

Every rating scale needs a "why" question. Numbers show magnitude. Narratives reveal mechanism.

Example structure:

This pairing enables correlation analysis that connects quantitative change to qualitative drivers.

Capture program variables (instructor, curriculum version, location, cohort) and demographic data to enable segmentation analysis. You'll want to compare outcomes across groups later.

Without metadata, you can report aggregate improvement but can't identify which program variations work better or which participant segments need different support.

Most participants complete surveys on phones. If your pre assessment requires excessive scrolling, has tiny tap targets, or breaks on mobile browsers, completion rates plummet.

Design mobile-first, desktop second. Test on actual devices before launch.

Administer pre surveys immediately before the program starts—not weeks earlier when context has faded. Administer post surveys immediately after key milestones while memory is fresh.

For programs with persistence goals, plan 3-month, 6-month, or 12-month follow-ups from the beginning. Longitudinal tracking reveals whether gains persist or fade.

Most pre and post survey analysis stops at calculating averages. "Test scores improved 35%." Done. But that hides who benefited, why change happened, and what to do next. Here are five analysis techniques that move beyond simple before-and-after comparisons.

Here's what becomes possible when you track individuals over time rather than collecting disconnected snapshots:

You can answer questions like:

Instead of two disconnected data points, you get trajectories. You see the journey.

This isn't just better data. It's a completely different kind of evidence. Organizations doing this well aren't just reporting outcomes—they're proving them.

The matching problem solution: From the very first touchpoint, every participant gets a unique identifier. Not a code they have to remember—an ID that lives in the system. When they complete their pre-survey, it's linked. When you interview them three months later, it's linked. When they take a follow-up assessment, it's linked.

Automatically. No manual matching. No guessing which Sarah is which.

The analysis advantage: AI analyzes change patterns across all your data—quantitative surveys, qualitative interviews, everything connected. You can track how confidence shifts, how skills develop, how behaviors change. At the individual level and across entire cohorts.

The result is longitudinal evidence that actually holds up when funders start asking hard questions.

The gap between traditional and modern pre post survey analysis has widened dramatically. Here's what the comparison looks like:

The bottom line: Traditional analysis takes 5-7 months and delivers retrospective reports. Modern analysis takes minutes and enables adaptive programming.

Even minor edits ("confidence" → "self-assurance") break comparability. You can't measure change if the instrument shifted.

Fix: Lock baseline survey questions. Version any changes and note them in analysis. Never silently modify wording mid-cycle.

Collecting baseline data in Google Forms and post-data in SurveyMonkey fragments identity management and creates cleanup nightmares.

Fix: Use one platform with built-in ID linking that automatically connects pre/post responses to the same participant.

Rating scales show magnitude of change but hide mechanism. Without qualitative context, you can't explain why outcomes varied.

Fix: Add one open-ended "why" question for every key metric. AI can structure responses automatically—no manual coding required.

Traditional analysis cycles mean insights arrive months after data collection—too late to help current participants.

Fix: Use real-time analysis tools that process data as it arrives. Mid-program adjustments compound impact across remaining weeks.

Asking participants to remember and enter a code they created weeks ago guarantees broken connections and incomplete matching.

Fix: Generate unique identifiers automatically. Send personalized survey links that embed the ID. Participants never need to remember anything.

Immediate post-program surveys capture short-term change. Without 3-month or 6-month follow-ups, you can't prove gains persisted.

Fix: Plan follow-up timing from the beginning. Budget for longitudinal tracking. Report both immediate and sustained outcomes.

Imagine surveys that evolve with your needs, keep data pristine from the first response, and feed AI-ready datasets in seconds—not months.

AI-Native: Upload text, images, video, and long-form documents. Transform them into actionable insights instantly.

Smart Collaboration: Seamless team collaboration makes it simple to co-design forms, align data across departments, and engage stakeholders to correct or complete information.

True Data Integrity: Every respondent gets a unique ID and link—automatically eliminating duplicates, spotting typos, and enabling in-form corrections.

Self-Driven: Update questions, add new fields, or tweak logic yourself. No developers required. Launch improvements in minutes, not weeks.

Stop collecting snapshots. Start capturing journeys. Turn your pre and post survey data into evidence that proves impact—and shows you exactly how to replicate it.