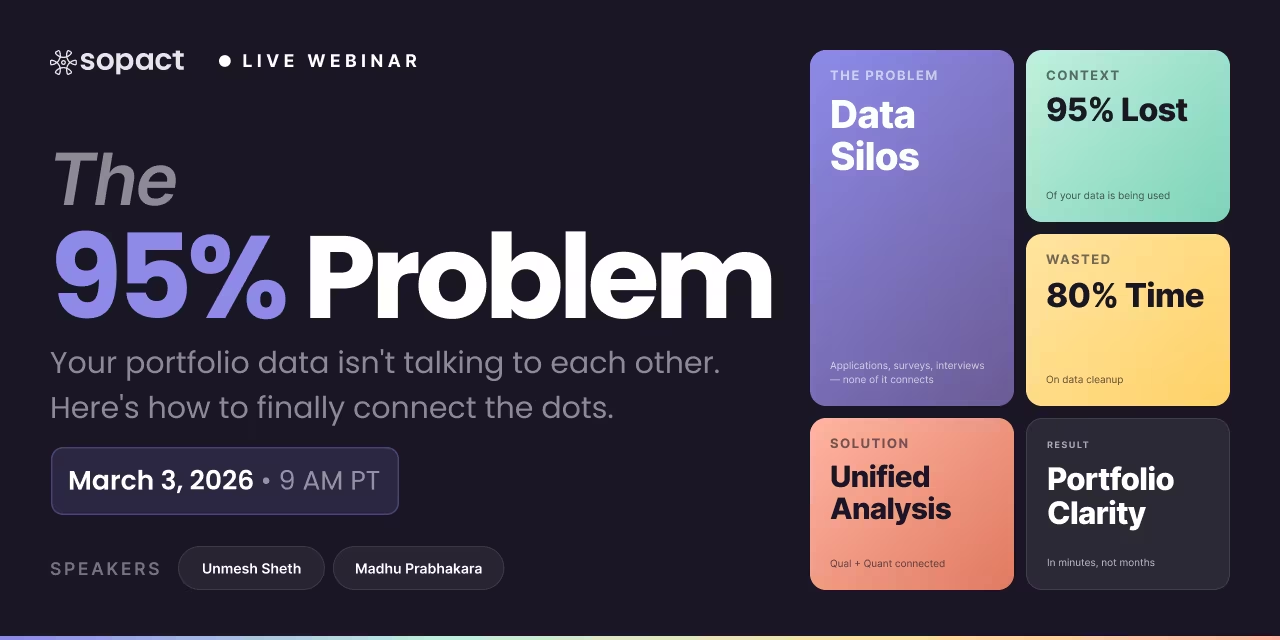

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Open-ended question examples for surveys, questionnaires, and research. Learn how to write questions that produce analyzable responses

Most organizations ask open-ended questions and then do nothing useful with the answers.

They collect hundreds of free-text responses, skim a few for quotable highlights, and file the rest. Not because the data lacks value—but because manually analyzing qualitative feedback takes weeks. By the time themes emerge, decisions have already been made.

An open-ended question is any survey, questionnaire, or interview question that allows respondents to answer in their own words rather than selecting from predefined options. Instead of choosing "satisfied" or "dissatisfied," respondents describe what actually happened, why it mattered, and what they'd change. That narrative data contains patterns about barriers, satisfaction drivers, and improvement opportunities that no rating scale can capture.

The challenge has never been asking open-ended questions. It's been the gap between collecting rich qualitative data and actually using it. Traditional thematic coding takes 3–4 weeks per survey cycle. AI-powered analysis closes that gap to minutes—making open-ended questions practical at any scale.

This guide covers how to write open-ended questions that generate focused, analyzable responses, 50+ examples organized by use case (surveys, questionnaires, research, interviews, feedback), when open-ended questions outperform closed-ended alternatives and how to combine both strategically, and how modern analysis tools eliminate the bottleneck that made open-ended data impractical.

Let's start with what separates questions that produce insight from questions that produce noise.

Open-ended questions have no predetermined answer choices. Respondents write what they think matters, in whatever language feels natural to them. No checkboxes, no scales, no multiple-choice constraints—just a blank field waiting for their perspective.

Compare these two approaches to measuring the same thing:

Closed-ended: "How satisfied are you with the program? (Very satisfied / Satisfied / Neutral / Dissatisfied / Very dissatisfied)"

Open-ended: "What specific aspect of the program had the most impact on your work, and why?"

The closed-ended version produces a number. The open-ended version produces evidence. Both matter, but they answer fundamentally different questions. The rating tells you how much people liked something. The narrative tells you what worked, what didn't, and why.

Open-ended questions give respondents control over what to emphasize. This means they surface insights you never anticipated—a participant explaining that scheduling conflicts actually helped them form study groups, or a customer revealing that your onboarding process accidentally solved a problem you didn't know existed. No predefined answer list could have captured those discoveries.

That discovery power comes with a cost. Open-ended responses require interpretation. Five thousand narrative answers don't summarize themselves the way five thousand Likert-scale ratings do. This is precisely why most organizations underuse open-ended questions—not because the questions aren't valuable, but because the analysis traditionally didn't scale.

You're exploring, not measuring. You don't yet know what matters, so you can't write meaningful answer choices. Use open-ended questions in pilot programs, early-stage research, and any context where the goal is learning what to measure next.

You need the "why" behind a number. Satisfaction dropped 15%—but why? Confidence improved—but because of what? Open-ended questions reveal the causal story behind quantitative shifts. Pair them with rating scales for the most actionable data.

You want evidence, not just claims. "95% reported improved confidence" is a metric. "I negotiated a 20% raise using skills from Module 3" is evidence. Funders, boards, and stakeholders find specific examples more persuasive than aggregate statistics.

You're validating assumptions before scaling. Before creating a multiple-choice questionnaire, run an open-ended pilot. If 80% mention technology access and nobody mentions time constraints, your planned answer options need revision.

You need to capture unexpected outcomes. Programs rarely work exactly as designed. Closed-ended questions measuring intended outcomes miss unintended benefits. Open-ended formats catch what you didn't think to ask about.

Open-ended questions favor articulate respondents. People who write well produce rich, detailed responses. People with language barriers, learning differences, or time constraints produce fragments that are harder to interpret.

This creates systematic bias. Completion rates drop measurably when surveys demand too much writing. If your program serves populations with limited literacy or English fluency, over-relying on open-ended questions inadvertently excludes the voices you most need to hear.

The solution isn't avoiding open-ended questions entirely. It's being strategic: use them where their depth justifies the respondent burden, keep them focused so people can answer quickly, and combine them with closed-ended questions that lower the overall effort.

The difference between a useful open-ended question and a useless one comes down to specificity. "Any comments?" generates noise. Questions that target specific dimensions—barriers, outcomes, confidence, application—generate data you can analyze for patterns.

These work in any structured data collection instrument—online surveys, paper questionnaires, evaluation forms, or feedback tools.

Outcome-focused questions reveal what actually happened:

Barrier-identification questions surface obstacles worth fixing:

Process-reflection questions capture what works and what breaks:

Improvement-suggestion questions crowdsource solutions:

Confidence-assessment questions reveal readiness:

Academic and applied research requires questions that generate data suitable for rigorous thematic analysis while maintaining methodological integrity.

Exploratory research:

Mixed-methods follow-up (pairing open-ended with quantitative measures):

Qualitative interview questions:

These pair with NPS, CSAT, or other satisfaction metrics to explain what's driving scores.

Post-interaction feedback:

Open-ended feedback for product development:

Engagement and retention:

360° and development feedback:

Good questions share structural characteristics that prompt focused, detailed responses. Bad questions share structural flaws that guarantee vague, unusable data.

Before writing the question, define the decision it needs to inform. "Get feedback" is not a goal. "Identify the top barriers preventing program completion" is a goal. Clarity about what you'll do with the data shapes questions that generate data worth using.

Weak goal → weak question: "Learn about participant experience" → "How was the program?"Strong goal → strong question: "Identify barriers to skill application" → "What specific challenge made it most difficult to apply what you learned in your daily work?"

Replace abstract prompts with concrete ones. "How do you feel about..." invites vague opinions. "Describe a specific situation where..." invites evidence.

Weak phrasingStrong phrasing"What do you think about the training?""What skill from the training have you applied, and what happened when you tried?""How was the mentorship?""Describe one moment when mentorship helped you overcome a specific challenge.""Any feedback on the program?""What aspect of the program should we keep exactly as it is, and why?"

Words like "describe," "explain," "walk me through," and "what specific..." consistently produce more detailed, analyzable responses than "think," "feel," or "comment."

"What did you like and dislike about the curriculum and instructors?" asks four questions disguised as one. Respondents answer whichever part they remember. You can't tell which dimension they're addressing.

Split compound questions:

Each response now addresses a single, clear dimension that you can code and compare across respondents.

"What did you love about our program?" assumes positive experience and signals that criticism isn't welcome. Respondents who struggled either force a positive answer or skip the question. Either way, you've eliminated the feedback most worth hearing.

Biased: "What amazing benefits did our training provide?"Neutral: "What impact, if any, has the training had on your daily work?"

Neutral framing gives respondents permission to share authentic perspectives, including the critical ones that reveal where to improve.

"Describe your experience" is unlimited—and overwhelming. Respondents don't know where to start, so they either write everything or nothing.

"What was the single biggest barrier you faced during implementation?" has clear boundaries. One barrier. One timeframe. Respondents know exactly what to address, and you get focused answers you can categorize.

Adding temporal framing helps further: "In the past month, what challenge has been most difficult to resolve?" creates a specific window that aids recall and makes responses comparable.

When using platforms with automated analysis capabilities, embed the dimensions you want to measure directly in the question.

Hard to analyze: "Tell me about your experience."Analysis-ready: "Describe your confidence level in using [specific skill] and explain what factors influence that confidence."

The second version lets automated tools extract both confidence categories (low/medium/high) and contributing factors (training quality, practice time, manager support) across all responses simultaneously—turning subjective narratives into quantifiable patterns without manual coding.

The question isn't which type is better. It's which type answers the question you're actually asking.

Use closed-ended questions when you need:

Use open-ended questions when you need:

Use both together when you need the full picture. The most effective surveys pair a closed-ended metric with an open-ended follow-up:

This combination gives you trackable numbers and the context to understand what drives them. The closed-ended question tells you that something changed. The open-ended question tells you why.

If you've worked with "fixed-alternative questions" or "single-response questions," these are variations of closed-ended formats. Fixed-response questions provide a set list of answer options. Single-response questions limit selection to one choice. Both constrain answers to categories you defined in advance.

Open-ended questions remove that constraint entirely. When you're unsure which categories matter, or when the most important insight might not fit any predefined option, open-ended formats prevent you from accidentally excluding critical data.

Five patterns kill the value of open-ended questions before analysis even begins:

Generic prompts produce generic answers. "Any additional comments?" is the most wasted question in survey design. It gives no direction, so most people skip it. Those who answer write about whatever occurs to them, producing responses too scattered to analyze.

Fix: Replace with a specific prompt. "What one change would improve this program most?" gives clear direction while staying open-ended.

Leading questions bias responses. "What did you enjoy about the workshop?" assumes enjoyment. People who didn't enjoy it either force a positive answer or abandon the question.

Fix: Use neutral framing. "Describe your experience with the workshop, including what worked and what didn't."

Compound questions confuse respondents. "How was the content, the instructor, and the venue?" asks three questions wearing one question's clothing. You can't tell which part any given response addresses.

Fix: Split into separate questions, each targeting one dimension.

Poor placement kills completion. Five open-ended questions after fifteen rating scales guarantees survey fatigue. By the time people reach your most important qualitative question, they're done caring.

Fix: Place your highest-priority open-ended question early, when engagement is highest. Limit total open-ended questions to 2–3 per survey. Make each one count.

Questions too broad for analysis. "Tell us about your experience" could mean anything. Analysis becomes impossible when every response covers different territory.

Fix: Bound the scope. "What was the single most valuable skill you gained?" forces respondents to prioritize, giving you comparable data across all participants.

Question order affects response quality as much as question wording.

Start with closed-ended warmups. Rating scales and multiple-choice questions build momentum. Respondents settle into the survey rhythm with quick, low-effort answers before encountering questions that require more thought.

Place your most important open-ended question in the first third. Engagement peaks early. If you need one high-quality qualitative response, don't bury it at question 15.

Use closed-ended questions to set up open-ended follow-ups. "Rate your satisfaction: 1–10" followed by "What specific factor most influenced your rating?" creates context. The respondent has already reflected on their satisfaction before you ask them to explain it.

Limit open-ended questions to 2–3 per survey. Each one requires meaningful cognitive effort. More than three and completion rates drop measurably. Choose the questions that will generate the most actionable insights.

End with a focused suggestion question, not "any comments." "If you could change one thing about this program, what would it be?" generates more useful closing data than an open comment box.

The traditional barrier to open-ended questions was always analysis, not collection. Organizations knew qualitative data was valuable but couldn't justify the weeks of manual coding required to extract themes from hundreds of responses.

Manual thematic coding follows a labor-intensive process: read every response, develop a coding framework, tag each response against the framework, validate consistency, then aggregate findings. For 500 responses, this takes 3–4 weeks of focused analyst time. By the time insights emerge, program cohorts have moved on and customer concerns have compounded.

AI-powered analysis fundamentally changes the calculation. Modern tools process open-ended responses as they arrive, identifying themes, extracting sentiment, and surfacing patterns in minutes rather than weeks.

Traditional workflow: Collect responses → Export to spreadsheet → Read manually → Create theme categories → Code each response → Validate coding → Aggregate findings → Report (3–4 weeks)

AI-powered workflow: Collect responses → Automatic theme extraction → Pattern identification → Quantified insights with original context preserved (minutes)

This shift doesn't just save time. It changes which questions organizations ask. Teams that know their analysis tool can handle qualitative data ask more open-ended questions—and get richer insights as a result. Teams limited to manual analysis default to closed-ended formats because at least the numbers appear immediately, even when those numbers can't explain what's actually happening.

Sopact Sense applies this approach through Intelligent Cell: you provide plain-English instructions like "extract confidence levels from this feedback" or "identify common barriers to program completion," and the system processes hundreds of responses automatically. Themes are quantified. Sentiment is measured. Original quotes are preserved for context. The result is the depth of qualitative analysis at the speed of quantitative reporting—without the 3–4 week bottleneck that made open-ended questions impractical at scale.

Closed-ended questions provide predefined answer choices—multiple-choice options, yes/no responses, rating scales, or ranked lists. Respondents select from options you defined before data collection. Open-ended questions remove that constraint, allowing respondents to answer in their own words without restrictions. Closed-ended questions generate quantitative data that's immediately measurable but may miss unexpected context. Open-ended questions capture qualitative depth that reveals why respondents feel a certain way, what barriers they face, and what solutions they'd suggest.

The strongest open-ended survey questions are specific and focused on a single dimension. Examples include "What specific challenge made it most difficult to apply what you learned?" for program evaluation, "What aspect of your experience most influenced the score you just gave?" for customer feedback, and "What would make you more confident in your current role?" for employee engagement. Avoid vague questions like "Any comments?" or "What do you think?" which generate unfocused responses impossible to analyze systematically.

Traditional manual analysis requires reading every response, creating theme categories, and coding patterns by hand—a process taking 3–4 weeks per survey cycle. AI-powered analysis tools like Sopact Sense process responses as they arrive, automatically extracting themes, measuring sentiment, and converting narratives into quantifiable metrics. This approach delivers the accuracy of expert coding with the speed of automated analysis, reducing weeks of work to minutes while capturing more nuanced insights.

Limit open-ended questions to 2–3 per survey. Each one requires meaningful cognitive effort from respondents, and too many drives down completion rates and response quality. Choose the 2–3 questions that will generate the most actionable insights for your specific decisions, and pair them with closed-ended questions that provide the quantitative context.

Yes. Open-ended questions complement quantitative research by explaining what drives the numbers. In mixed-methods designs, researchers use closed-ended questions for measurement and open-ended questions for interpretation. A pre/post confidence rating (1–10) paired with "What changed your confidence level?" gives you both a measurable trend and the causal story behind it. AI analysis makes this combination practical even in large-sample studies.

An open-ended questionnaire is a structured data collection instrument that primarily or exclusively uses free-text response questions rather than predefined answer choices. Researchers use open-ended questionnaires in exploratory studies, qualitative research, and situations where the range of possible responses isn't known in advance. They're particularly valuable during pilot phases when you need to discover what matters before creating a closed-ended measurement instrument.

Fixed-response questions (also called fixed-alternative questions or single-response questions) provide a predetermined set of answer options. Respondents choose one or more options from a list you created before data collection. These are the opposite of open-ended questions. Use fixed-response formats when you know the possible answers in advance and need standardized, easily quantifiable data. Use open-ended formats when you're discovering possibilities rather than measuring known categories.

Open-ended questions that evolve with your needs, keep data pristine from the first response, and feed AI-ready datasets in seconds—not months.

AI-Native — Upload text, images, video, and long-form documents and let our agentic AI transform them into actionable insights instantly.

Smart Collaborative — Seamless team collaboration making it simple to co-design forms, align data across departments, and engage stakeholders.

True Data Integrity — Every respondent gets a unique ID and link. Automatically eliminating duplicates, spotting typos, and enabling in-form corrections.

Self-Driven — Update questions, add new fields, or tweak logic yourself—no developers required. Launch improvements in minutes, not weeks.