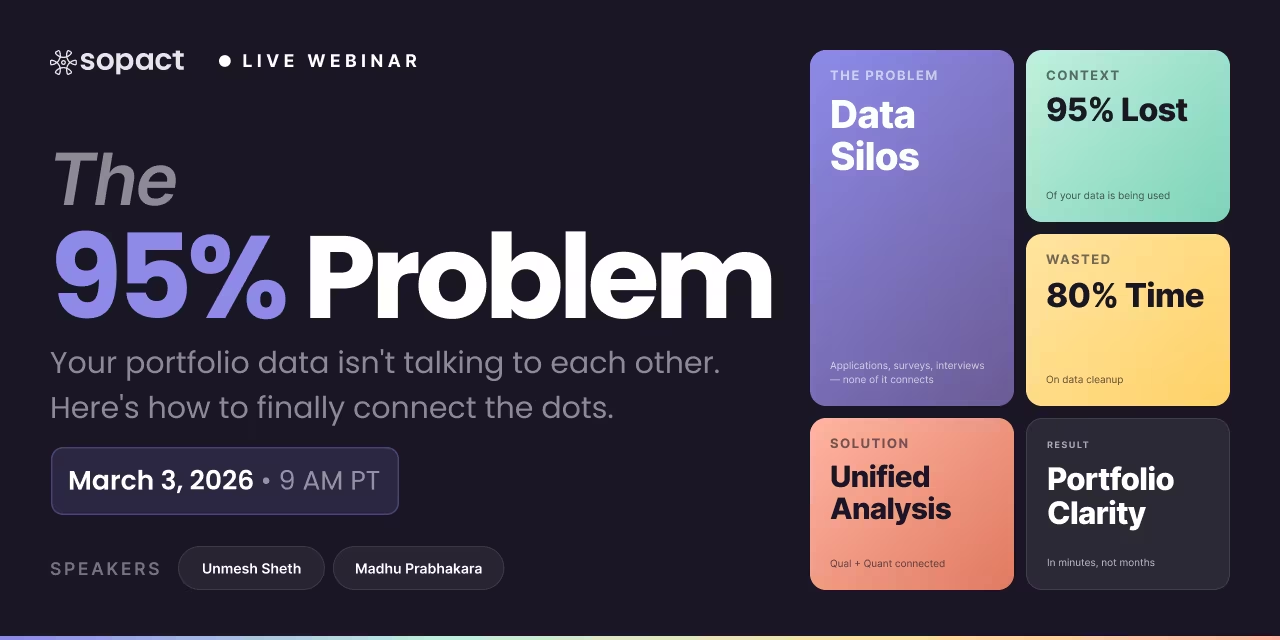

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Longitudinal tracks change over time; cross-sectional captures current patterns. Both fail without clean data collection.

You need to prove your program works. But which research design actually delivers that proof?

Longitudinal study tracks the same participants over time. Cross-sectional study captures different participants at one moment. The choice determines whether you can prove causation—or only describe correlation.

This isn't an academic distinction. When funders ask "Did your program cause this improvement?", only longitudinal data can answer definitively. When stakeholders need quick baseline comparisons, cross-sectional data delivers in weeks instead of years.

Most organizations choose wrong because they don't understand what each design can—and cannot—prove. This guide gives you a clear decision framework, side-by-side comparison, and practical examples showing when each approach makes sense.

For deeper dives into specific approaches, see our guides on longitudinal study design, longitudinal data collection, and longitudinal data analysis.

Before diving into comparisons, let's establish clear definitions:

Longitudinal Study A research design that tracks the same participants across multiple time points to measure change within individuals. You follow Sarah from program start through completion and beyond—watching her transform over months or years.

Cross-Sectional Study A research design that captures data from different participants at a single point in time to compare groups. You survey 500 people today—comparing those in your program to those not in it.

The core distinction: Longitudinal studies measure within-person change. Cross-sectional studies measure between-group differences.

This difference determines everything: what questions you can answer, what evidence you can produce, and whether you can prove your intervention actually caused observed outcomes.

The right choice depends on your research question, timeline, and what evidence your stakeholders require.

1. You need to prove causationFunders increasingly demand evidence that programs caused observed changes—not just that change happened alongside your program. Longitudinal design establishes temporal sequence: the intervention preceded the outcome.

2. Individual trajectories matterIf you need to know who improved (not just whether averages shifted), you need longitudinal tracking. This enables targeted interventions for participants who aren't progressing.

3. You can maintain participant contactLongitudinal studies require following the same people over time. If participants are transient or you lack tracking infrastructure, cross-sectional may be your only option.

4. Long-term outcomes are the goalEmployment 6 months after graduation, sustained behavior change, lasting skill retention—these require follow-up data that only longitudinal design provides.

5. Stakeholders demand strong evidenceAcademic publications, policy advocacy, and sophisticated funders expect longitudinal evidence. Cross-sectional data may not satisfy their evidentiary standards.

For guidance on designing effective longitudinal research, see our guide on longitudinal study design.

1. Speed matters more than causationGrant report due in 3 weeks? Stakeholder meeting next month? Cross-sectional data delivers insights in days—not the months or years longitudinal studies require.

2. You need baseline comparisonsBefore launching a new program, cross-sectional surveys establish where participants start. This baseline becomes the comparison point for future longitudinal tracking.

3. Participants are transientIf people pass through your program briefly and can't be contacted afterward, cross-sectional capture during participation may be your only option.

4. Group patterns are sufficientSometimes you don't need to prove causation—you need to compare groups, measure prevalence, or identify patterns across populations. Cross-sectional handles this efficiently.

5. Budget limits data collectionRepeated measurement costs more. If resources are limited, one high-quality cross-sectional snapshot may deliver more value than an underfunded longitudinal study with high attrition.

Answer these questions to identify your best research design:

Question 1: Do you need to prove your program caused observed changes?

Question 2: How quickly do you need results?

Question 3: Can you maintain contact with participants over time?

Question 4: What's your primary research question?

Question 5: What evidence do stakeholders require?

1. Establishes causationBy tracking the same individuals before, during, and after intervention, longitudinal studies demonstrate that your program preceded observed changes—essential for proving impact.

2. Controls for individual differencesEach participant serves as their own control. Sarah's post-program confidence compared to Sarah's pre-program confidence—not compared to different people who may have started with advantages.

3. Reveals change patternsLongitudinal data shows trajectories: who improves rapidly, who plateaus, who needs additional support. This enables real-time program adaptation.

4. Identifies predictorsWhich baseline characteristics predict success? Longitudinal studies answer this by tracking who achieves outcomes and correlating with starting points.

5. Provides strongest evidenceFor policy advocacy, academic publication, or sophisticated funders, longitudinal evidence carries more weight than cross-sectional comparisons.

For detailed analysis techniques, see our guide on longitudinal data analysis.

1. Time intensiveResults take months or years. If you need insights for next quarter's board meeting, longitudinal studies won't deliver in time.

2. Higher costRepeated data collection, participant tracking systems, and extended timelines increase expenses significantly compared to one-time surveys.

3. Participant attritionPeople move, disengage, or stop responding. Losing 30-40% of participants can bias results and undermine conclusions.

4. Tracking complexityMaintaining consistent IDs, updated contact information, and measurement tools across years requires infrastructure that traditional survey tools don't provide.

5. Delayed insightsBy the time you prove long-term impact, your program may have evolved. Insights about the 2023 version arrive in 2025 when you're running the 2025 version.

1. Fast results Collect data once, analyze immediately. Cross-sectional studies deliver insights in days or weeks—perfect for tight deadlines.

2. Lower cost Single data collection event requires minimal resources. No tracking infrastructure, no follow-up costs, no extended timelines.

3. No attrition risk Participants respond once and leave. No dropout problem that biases results or reduces statistical power.

4. Large samples feasible Survey thousands simultaneously without the burden of maintaining long-term relationships with each participant.

5. Minimal participant burden One 15-minute survey versus multiple sessions over months. Lower burden improves response rates and data quality.

1. Cannot prove causationS hows correlation only. You can't determine if your program caused observed differences—or if they reflect pre-existing group characteristics.

2. No individual change data Measures group averages at one moment. Can't identify whether specific individuals improved, declined, or stayed stable.

3. Cohort effects Differences between groups may reflect selection bias rather than program impact. More motivated people may self-select into your program.

4. Temporal ambiguity Can't establish what came first. Did skills cause confidence? Or did confident people seek skill training?

5. Limited for evaluation Funders increasingly demand proof of causation. Cross-sectional data alone rarely satisfies outcome requirements for serious impact evaluation.

Research Question: Does our 12-week coding bootcamp improve employment outcomes?

Cross-Sectional Approach:Survey current participants and compare to a control group of similar people who didn't enroll. Find that participants have 20% higher employment rates.

Limitation: Can't prove the bootcamp caused higher employment. Maybe people with higher employment potential were more likely to enroll.

Longitudinal Approach:Track 150 participants from intake through 6 months post-graduation. Measure employment status at baseline, exit, 90 days, and 180 days.

Finding: Employment increased from 45% at baseline to 78% at 180 days. Individual trajectories show who succeeded and what baseline factors predicted outcomes.

Verdict: Longitudinal study proves the program drove employment gains for these specific individuals.

Research Question: How satisfied are our customers with our new product?

Cross-Sectional Approach:Survey 1,000 customers about their satisfaction with the new product. Find average satisfaction is 7.8/10.

Strength: Quick baseline measurement. Identifies which segments are more/less satisfied.

Longitudinal Approach:Track 200 customers from purchase through 6 months, measuring satisfaction at day 1, 30, 60, and 90.

Finding: Satisfaction starts at 8.2/10 but drops to 6.5/10 by day 90 as novelty wears off and issues emerge.

Verdict: Cross-sectional missed the satisfaction decline. Longitudinal revealed the trajectory pattern that enables intervention.

Research Question: Does our mentorship program improve youth outcomes?

Cross-Sectional Approach:Compare current mentees to similar youth not in program. Find mentees show higher academic confidence.

Limitation: Selection bias—maybe confident youth were more likely to join mentorship.

Longitudinal Approach:Track 200 youth from enrollment through 2 years. Measure confidence, grades, and goal achievement quarterly.

Finding: Academic confidence increased 2.4 points on average. Youth with mentors showed 2x the gains of those matched but not yet assigned mentors (internal control group).

Verdict: Longitudinal study with internal comparison group provides strong causal evidence that mentorship drove improvement.

You don't always have to choose. Mixed methods combine both designs:

Cross-sectional foundation: Survey all program participants at one point to establish baseline patterns across groups.

Longitudinal depth: Track a subset of participants over time to prove causation and measure sustained outcomes.

Benefits:

When to use mixed methods:

For implementation guidance, see our guide on longitudinal surveys.

The longitudinal vs cross-sectional study choice matters—but data quality matters more. Both designs fail when:

Participant IDs fragment: Sarah becomes #4782 in wave 1 and #6103 in wave 2. Longitudinal tracking becomes impossible.

Data lives in silos: Baseline in one spreadsheet, follow-up in another. Manual matching wastes weeks and introduces errors.

Follow-up creates friction: Generic links confuse participants. Attrition spikes because returning to surveys is burdensome.

Analysis lags behind collection: Insights arrive months after data collection—too late to adapt programs.

Sopact Sense solves this at the source:

The design choice (longitudinal vs cross-sectional) defines what questions you can answer. The infrastructure choice defines whether you can answer them accurately.

For more on building clean data workflows, see our guide on longitudinal data.

Choosing between longitudinal and cross-sectional study design is strategic. Turning findings into action is transformative.

Sopact Sense handles data collection with built-in infrastructure for both longitudinal and cross-sectional designs.

Claude Cowork transforms patterns from either design into specific actions: communications, interventions, recommendations, reports.

The longitudinal vs cross-sectional study decision shapes what evidence you can produce:

The infrastructure choice matters as much as the design choice. Both approaches fail without clean data collection workflows that maintain participant connections and enable real-time analysis.

Sopact Sense supports both longitudinal and cross-sectional designs through the same platform—unique participant IDs, centralized data, personalized follow-up, and instant analysis.

Claude Cowork turns findings from either design into action within hours, not months.

Your next steps:

🔴 SUBSCRIBE — Get the full video course

⬛ BOOKMARK PLAYLIST — Save for reference

📅 Book a Demo — See both research designs in action

Related Guides: