Sopact is a technology based social enterprise committed to helping organizations measure impact by directly involving their stakeholders.

Useful links

Copyright 2015-2025 © sopact. All rights reserved.

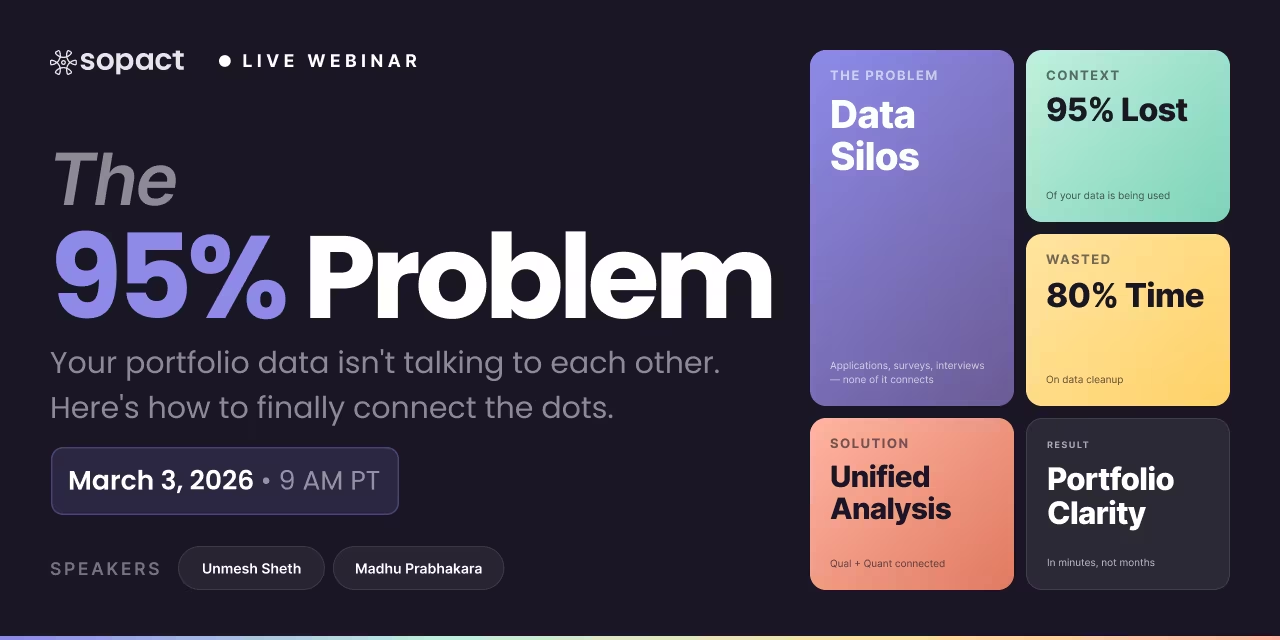

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Most impact fund due diligence drowns in documents. Sopact Sense scores, synthesizes, and carries context from DD through quarterly reporting — automatically

Author: Unmesh Sheth

Last Updated:

February 15, 2026

Founder & CEO of Sopact with 35 years of experience in data systems and AI

Impact investing due diligence is the systematic assessment of an investment's potential for measurable social or environmental impact alongside financial returns. The global standard — established by the Impact Management Project (now Impact Frontiers) — evaluates investments across the Five Dimensions of Impact. Effective DD connects screening findings, onboarding context, and quarterly reporting into a continuous intelligence loop — ensuring every insight generated during evaluation informs ongoing portfolio management.

Impact investing due diligence fails not because fund managers lack effort — it fails because every tool treats due diligence, onboarding, and reporting as separate activities, resetting context at each stage. Pacific Community Ventures' Impact DD Guide identified three common approaches (narratives, questionnaires, scoring tools) — all produce static assessments that disconnect from post-investment monitoring. The IFC's AIMM system proved connected architecture works, but required development-finance-institution scale. Sopact Sense brings that architecture to every impact fund: AI scores documents against the Five Dimensions, onboarding inherits findings into a living Theory of Change, and quarterly reporting auto-generates six LP-ready reports from accumulated context. The result is a system that gets smarter with every interaction.

Impact investing due diligence fails because the tools treat screening, onboarding, and reporting as separate activities — resetting context at every stage transition. Fund managers generate valuable intelligence during document review that vanishes the moment capital is deployed. The problem is architecture, not effort.

Every major framework body — Impact Frontiers (IMP), the IFC Operating Principles, GIIN — has published clear standards for impact DD. Fund managers know they should score across the Five Dimensions. They know Theory of Change should be a living document. They know stakeholder voice matters.

The problem is execution. An analyst receives 50–200 documents per investee. They review them manually, in email threads and shared drives. They build a scoring rubric in a spreadsheet — different from the rubric the last analyst built. They produce a DD memo. The investment committee approves. And then? The DD output gets filed away. Onboarding starts from scratch. Quarterly reporting starts from scratch. The TOC written during DD never gets updated.

Pacific Community Ventures' landmark Impact Due Diligence Guide identified three common approaches: narratives of expected impact, due diligence questionnaires, and quantitative scoring tools. Each serves a purpose. But all three share a critical flaw — they produce static assessments that disconnect from post-investment monitoring. The PCV guide recommends linking pre- and post-investment measurement, noting it "empowers the investor and the investee to test their assumptions, identify risks and course-correct." In practice, almost no one does this.

The GIIN's State of the Market 2025 report shows impact AUM growing at a 21% compound annual rate over six years. Yet most fund managers building this market still compile quarterly impact reports manually — spending weeks pulling data that should flow automatically from the due diligence they already completed.

This isn't a knowledge problem. It's an architectural one. The tooling doesn't connect the stages. And when stages aren't connected, context is lost — and with it, the entire foundation of evidence-based impact measurement and management.

Bottom line: Impact fund DD doesn't fail from lack of rigor — it fails because disconnected tools force teams to rebuild context at every stage, wasting the intelligence they already generated.

The industry has matured dramatically in its understanding of effective impact DD — but the tooling hasn't kept pace. The frameworks are sophisticated; the execution infrastructure is stuck in 2015. Every fund manager feels this gap between what best practice demands and what their tools can actually deliver.

The PCV guide outlines seven areas of best practice: assessing impact using the Five Dimensions, bridging ESG and impact, aligning with SDGs, elevating stakeholder perspectives, evaluating organizational commitment, portfolio-wide approach, and accessibility. These are the right principles. But the guide itself acknowledges the implementation challenge: developing a quantitative impact DD tool requires a dedicated project lead spending "at least five hours weekly for four to twelve months" — and that's just to build the tool, not run it.

BlueHub Capital's experience is instructive: their VP of Learning and Impact Measurement worked with loan officers to develop scoring rubrics, pilot them across historic loans, and refine guidelines. Even after implementation, scoring takes 30–45 minutes per prospective loan — with no automatic handoff to post-investment monitoring. The IFC's AIMM system is one notable exception that structurally connects front-end diagnostics to results measurement and ex-post evaluation. But replicating that architecture has required development-finance-institution scale — until now.

Bottom line: The frameworks are mature. The tooling is stuck in 2015. Sopact Sense was built to close this gap — not by replacing human judgment, but by giving fund managers the architecture to execute the DD best practices they already know.

A three-stage workflow fixes impact due diligence by connecting screening, onboarding, and quarterly reporting into a single intelligence loop where every stage inherits context from the last — eliminating the data loss that makes traditional processes so wasteful.

Sopact Sense Layer 2 — Stakeholder Intelligence — connects the three stages that every impact fund runs but no tool unifies. The IFC's AIMM system proved this architecture works; Sopact Sense brings it to every impact fund without requiring IFC-scale resources.

Every document review in Sopact Sense is scored against the IMP consensus framework:

Upload all investee documents. Sopact Sense generates an AI scoring rubric aligned to the Five Dimensions of Impact — plus ESG screening — automatically. The rubric adapts to sector and investment stage: early-stage ventures weighted toward TOC clarity and team commitment; growth-stage toward outcome evidence and scale.

The PCV guide describes a seven-phase process for building quantitative DD tools — typically 4–12 months. Sopact compresses this by generating rubrics from your fund's stated impact thesis and the Five Dimensions, then applying them consistently across all candidates simultaneously. Every score is backed by evidence citations from source documents. No black boxes.

Community Vision's experience is telling: they significantly reduced their indicator count through testing, keeping only those that "meaningfully differentiated investment scores." Sopact's AI does this refinement continuously — identifying which indicators actually predict impact performance.

All DD context inherits automatically. Interview the investee — Sopact Sense synthesizes DD intelligence plus interview insights into a living Theory of Change and a shared Data Dictionary. Both parties align before data collection begins.

The TOC auto-maps to relevant SDG targets. Bridges Fund Management demonstrates this approach: they build investment-specific logic models in collaboration with investees during DD. Sopact automates this synthesis so every fund can do what Bridges does manually. The Data Dictionary aligns with IRIS+ Core Metrics Sets where applicable. Organizational responsiveness is assessed: does the investee have dedicated impact staff, board-level reporting, beneficiary feedback loops?

This is the foundation of effective impact measurement and management — and it starts during onboarding, not months later.

TOC + Data Dictionary + financial data + stakeholder feedback flow in. Sopact Sense produces six automated reports — every quarter, for every investee:

Stakeholder voice data — collected via Lean Data-style surveys through Layer 1 — is AI-coded and synthesized alongside quantitative metrics. The PCV guide emphasizes that "an accompanying narrative is critical to comprehensively communicating anticipated impact." Sopact generates both — quantitative scores and evidence-backed narratives — automatically.

Bottom line: The three-stage workflow eliminates context loss by connecting due diligence, onboarding, and quarterly reporting into a single intelligence loop where each phase builds on everything that came before.

95% context at every stage. Each phase inherits intelligence from the last. No data lost. No context reset.

See the Full Impact Fund Workflow →Context compounds because each quarter adds new data to the same intelligence loop — enabling longitudinal analysis, pattern recognition, and predictive insights that single-quarter snapshots can never provide. This is what the PCV guide means when it recommends "continuously refining" impact goals based on evidence.

Beyond quarterly reporting, connected DD architecture unlocks the full feedback loop — a continuous cycle that transforms raw data into portfolio intelligence:

Four layers of deepening intelligence emerge over time:

Bottom line: Connected architecture transforms due diligence from a one-time screening exercise into a compounding intelligence system where every quarter of data makes the next quarter's analysis more valuable.

Impact funds should start with Layer 2 — Stakeholder Intelligence — which connects document analysis, investee interviews, and quarterly data into a single loop. This is the fastest path to eliminating context loss between due diligence, onboarding, and reporting.

Starting with Layer 2 means fund managers can upload existing DD documents today and see AI-generated scoring rubrics within a week — no data migration, no IT involvement.

Bottom line: Start with Layer 2 to connect your existing due diligence documents to onboarding and quarterly reporting — then expand to Layer 1 for primary data collection and Layer 3 for deep portfolio analytics.

The Five Dimensions of Impact are the consensus framework developed by the Impact Management Project (now Impact Frontiers) for assessing and managing impact: What — the outcome being pursued; Who — the stakeholders affected and how underserved they are; How Much — scale, depth, and duration; Contribution — the investor's additionality; and Risk — the probability impact differs from expectations.

Sopact Sense builds Five Dimensions scoring directly into the DD workflow — every document review is automatically scored across all five dimensions, with evidence citations from source materials. This replaces the manual, inconsistent scoring that the PCV guide acknowledges as a persistent challenge.

Bottom line: The Five Dimensions provide the what-to-score framework; Sopact Sense provides the how-to-score-consistently infrastructure.

Traditional impact fund due diligence takes 2–6 weeks per deal — manual document review, spreadsheet-based scoring, email-thread deliberation. Multiply by 10–50 deals per fund and the time cost is staggering. Building the scoring tools alone requires 4–12 months, according to PCV's implementation research.

With Sopact Sense, AI-generated scoring rubrics are produced from uploaded documents in minutes, with evidence citations from source materials. BlueHub Capital's manual process takes 30–45 minutes per loan for scoring alone; Sopact's AI generates comparable assessments in seconds, freeing analysts to review and refine rather than do first-pass review themselves.

Bottom line: AI-powered due diligence reduces document analysis from weeks to days — without sacrificing rigor or audit trail quality.

The most significant shift in DD best practice is moving from "about stakeholders" to "from stakeholders." Leading funds now include beneficiary and customer perspectives as a formal DD input — not an afterthought. Methods include Lean Data-style light-touch surveys, structured interviews, and ongoing feedback loops.

The key is integrating this qualitative data alongside quantitative metrics throughout the investment lifecycle, not just collecting it once. Sopact Sense Layer 1 handles scalable stakeholder data collection; Layer 2 synthesizes it into the DD-to-reporting pipeline. The PCV guide identifies elevating stakeholder perspectives as one of its seven best practices, noting it helps "mitigate impact risk, amplify stakeholder voices, and develop feedback loops between investors and investees."

Bottom line: Stakeholder voice transforms impact DD from a desk exercise into a ground-truth assessment — but only if the tooling integrates it continuously, not as a one-time collection.

A Theory of Change is a causal model mapping how an investee's activities lead to intended outcomes: inputs → activities → outputs → outcomes → impact. For impact investors, the TOC serves as both a DD assessment tool and an ongoing measurement framework.

The problem: most TOCs are written once during DD and never updated. Best practice treats the TOC as a living hypothesis — updated quarterly as evidence accumulates, stakeholder feedback emerges, and conditions change. Bridges Fund Management demonstrates this by building investment-specific logic models collaboratively with investees. Sopact Sense generates TOCs from DD and interview data, then updates them automatically with each quarterly data cycle.

Bottom line: A living Theory of Change turns impact assumptions into testable hypotheses that improve with every quarter of real data.

Impact investing due diligence is the systematic assessment of an investment's potential for measurable social or environmental impact alongside financial returns. The global standard evaluates investments across the Five Dimensions of Impact: What outcome is pursued, Who experiences it, How Much change occurs, what is the investor's Contribution, and what Risk exists. Unlike ESG screening, which focuses on risk avoidance, impact DD assesses positive impact creation.

The Five Dimensions are the consensus framework from Impact Frontiers (formerly IMP): What — the outcome being pursued and its importance; Who — the stakeholders affected and how underserved they are; How Much — scale, depth, and duration; Contribution — the investor's additionality versus what would happen anyway; and Risk — the probability that impact differs from expectations. This framework is used by GIIN, IFC, and leading impact funds globally.

Traditional impact DD takes 2–6 weeks per deal with manual document review and spreadsheet-based scoring. Building quantitative scoring tools requires 4–12 months of dedicated effort. Sopact Sense reduces document analysis to minutes by applying AI-generated scoring rubrics aligned to the Five Dimensions across all investee materials simultaneously, with evidence citations from source documents.

A comprehensive impact DD reviews: impact reports, financial statements, Theory of Change documentation, beneficiary data, governance structures, ESG policies, geographic evidence, and past LP reports. The challenge isn't finding documents — it's extracting the 2% of signal from hundreds of pages. Sopact Sense scores every document against the Five Dimensions, surfacing evidence that matters and citing it directly.

Best practice connects DD directly to ongoing measurement through a living Theory of Change — a hypothesis that evolves with evidence. Post-investment measurement follows the continuous feedback loop: Design metrics → Collect data → Analyze patterns → Dialogue with investees → Course correct. The critical requirement is DD insights carrying forward; without this, post-investment measurement starts from zero.

The most significant shift in DD best practice is moving from "about stakeholders" to "from stakeholders." Leading funds include beneficiary perspectives as a formal DD input using Lean Data-style surveys, structured interviews, and ongoing feedback loops. The key is integrating qualitative data alongside quantitative metrics throughout the lifecycle, not just collecting it once.

A Theory of Change maps the causal pathway from investment activities to intended outcomes: inputs → activities → outputs → outcomes → impact. Best practice treats the TOC as a living hypothesis updated quarterly as evidence accumulates. Sopact Sense generates TOCs from DD findings and investee interviews, then updates them automatically with each quarterly data cycle.

Quarterly — and it shouldn't take weeks of manual compilation. LP expectations are evolving toward evidence-based narratives backed by stakeholder voice data, not just dashboards. Sopact Sense generates six report types per investee per quarter automatically: Unified Report, Missing Data, Target Miss, Unusual Activity, Risk Report, and LP-Ready Summary.

Stop losing context between stages.

See how Sopact Sense operationalizes impact DD best practice — from documents to decisions to LP reporting.