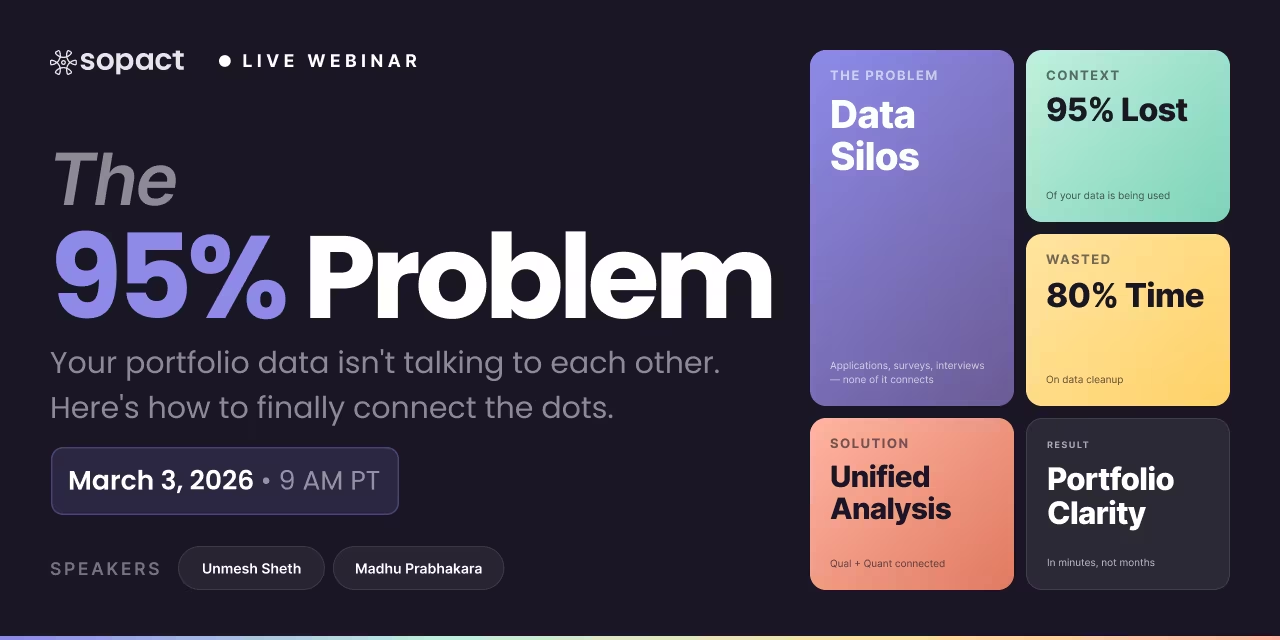

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Build audit-ready ESG due diligence with AI-powered tools. Checklist, DDQ framework, and supply chain intelligence that cuts data cleanup by 80%.

ESG due diligence is the structured assessment of a company's environmental, social, and governance practices — conducted before investment, acquisition, partnership, or during ongoing portfolio monitoring. It evaluates risks across emissions and climate exposure, labor practices and human rights, board independence and anti-corruption, and stakeholder engagement quality.

Unlike standard financial due diligence, which examines balance sheets and revenue projections, ESG due diligence examines operational, reputational, and regulatory risks that determine whether a company's value is sustainable over time. In 2026, it has evolved from a voluntary best practice into a legal obligation under frameworks like the EU's CSDDD and CSRD.

The critical gap most organizations face isn't knowledge — everyone understands ESG factors affect long-term value. The gap is execution: how you collect, structure, and analyze ESG data across dozens or hundreds of entities without spending 80% of your time cleaning fragmented data.

The regulatory landscape has shifted dramatically. The EU Corporate Sustainability Due Diligence Directive (CSDDD), adopted in May 2024, requires companies to identify, prevent, mitigate, and remediate human rights violations and environmental impacts throughout their chain of activities. Transposition deadlines hit July 2027, with compliance obligations beginning July 2028 for the largest companies.

This isn't another compliance checkbox. CSDDD demands evidence that your due diligence is effective at preventing harm — tracked longitudinally, with stakeholder perspectives included. Annual audits and static risk scores can't deliver what the law actually requires: continuous intelligence across your supplier and investment portfolios.

The Supply Chain ESG Due Diligence market reflects this urgency, projected to grow from $1.85 billion in 2024 to $5.33 billion by 2033 at a 14.2% CAGR. Europe is the fastest-growing region at 15.8% CAGR, driven directly by CSDDD implementation.

ESG due diligence looks different depending on context, but the underlying data challenges remain consistent:

Private Equity Pre-Investment: A PE firm evaluates a target company's emissions reporting, supply chain labor practices, board diversity metrics, and anti-corruption controls before committing capital. The firm needs to score qualitative governance disclosures alongside quantitative emissions data — and trace every score to its source evidence.

Portfolio Monitoring (LP Reporting): A fund manager collects quarterly ESG updates from 30 portfolio companies. Each company submits data in different formats — some via PDF reports, others through survey responses, others via email attachments. The fund needs consistent scoring across all entities, with trend analysis over time.

Supplier ESG Screening: A corporate procurement team assesses 200 suppliers against environmental compliance, labor standards, and governance criteria. Suppliers need unique assessment links that prevent duplicate submissions, and the team needs automated flagging of non-compliant responses.

M&A Transaction Due Diligence: An acquiring company evaluates a target's ESG risk profile across all three pillars within a compressed deal timeline — analyzing board evaluations, environmental permits, human rights policies, and stakeholder interviews simultaneously.

Real Estate ESG Assessment: A REIT evaluates properties against environmental certifications, energy efficiency data, community impact assessments, and governance of property management companies.

✦ Subscribe to Sopact | ☆ Bookmark Full Playlist

A comprehensive ESG due diligence checklist spans three pillars, each with specific assessment categories. This framework applies whether you're conducting pre-investment screening, ongoing portfolio monitoring, or supplier evaluation.

The environmental pillar evaluates a company's impact on natural systems and its exposure to climate-related risks.

Carbon and Emissions: Scope 1, 2, and 3 emissions data and methodology. Emissions reduction targets and progress tracking. Science-based targets alignment (SBTi commitment). Carbon offset strategies and verification.

Climate Risk: Physical risk exposure assessment (flooding, wildfire, heat stress). Transition risk evaluation (regulatory changes, technology shifts). TCFD-aligned climate scenario analysis. Climate adaptation and resilience plans.

Resource Management: Water usage and stewardship programs. Waste management and circular economy initiatives. Biodiversity impact assessment. Raw material sourcing sustainability.

Compliance: Environmental permits and licenses status. Regulatory violation history and remediation. Pollution management and prevention systems. Environmental liabilities (historical contamination, remediation obligations).

The social pillar assesses how a company manages relationships with employees, suppliers, customers, and communities.

Labor Practices: Employee health and safety records and incident rates. Fair wage policies and living wage commitments. Working hours, overtime, and rest policies. Freedom of association and collective bargaining rights.

Human Rights: Supply chain human rights due diligence processes. Modern slavery and forced labor risk assessment. Child labor prevention policies and verification. Community impact assessment and consultation.

Diversity, Equity, and Inclusion: Workforce demographic data by level. Pay equity analysis and gap disclosure. Inclusive hiring practices and targets. Anti-discrimination policies and complaint mechanisms.

Stakeholder Engagement: Customer satisfaction and complaint resolution. Community investment and engagement programs. Stakeholder consultation processes. Data privacy and cybersecurity protections.

The governance pillar examines the structures and processes that direct and control a company.

Board Structure: Board independence ratio and qualifications. Board diversity (gender, ethnicity, expertise). Committee structure (audit, compensation, ESG/sustainability). Board member ESG competency and training.

Executive Accountability: ESG-linked executive compensation and KPIs. Clear ESG responsibility assignment at C-suite level. Regular board reporting on ESG progress. Whistleblower mechanisms and protection policies.

Ethics and Compliance: Anti-corruption and anti-bribery policies. Code of conduct and enforcement. Political contribution and lobbying disclosure. Tax transparency and fair tax practices.

Reporting and Disclosure: ESG reporting framework alignment (GRI, SASB, ISSB, CSRD). External assurance and verification of ESG data. Materiality assessment process and frequency. Stakeholder communication and transparency.

Most ESG due diligence tools were designed for compliance — not intelligence. They can tell you a supplier scored 72/100 on labor practices, but they can't tell you why the score changed, whether corrective actions actually worked, or what workers themselves reported in open-ended feedback. Here's where the architecture breaks down.

The dominant ESG due diligence platforms — IntegrityNext, OneTrust, Ethixbase360 — automate risk scoring, sanctions screening, and compliance questionnaires. They answer "Is this supplier compliant?" but never "What's actually happening to workers and communities?"

When EcoVadis acquired Ulula in 2024 to add worker voice capabilities, it validated that stakeholder voice data matters. But their Worker Voice approach uses 18 standard KPI statements measured on Likert scales — structured, not open-ended. The analysis produces risk scores, not qualitative understanding. When workers provide narrative feedback about their actual experiences, no system deeply analyzes those responses across hundreds of suppliers over time.

CSDDD doesn't just require due diligence — it requires evidence that your due diligence is effective at preventing harm. You can only prove effectiveness by tracking change over time.

But current tools treat each audit or assessment as a standalone snapshot. There's no connection between last year's assessment, this quarter's worker survey, and next month's corrective action report. When you survey Supplier A's workers in Q1 and again in Q3, there's no connected identity tracking shifts in sentiment, emerging themes, or whether remediation actually changed experiences for the same entities.

Organizations collect worker surveys via one tool, audit reports via another, policy documents sit in shared drives, and corrective action plans live in spreadsheets. Nobody aggregates, normalizes, and makes this data AI-ready in one place.

The result is the "cleanup tax" — teams spend 80% of their ESG assessment time reconciling fragmented data instead of analyzing it. A quarterly ESG review that should take days stretches into weeks. Scores can't be traced to source evidence. And qualitative data — the interview transcripts, open-ended feedback, policy documents that contain the richest intelligence — dies between collection and analysis because nobody has time to read it.

Academic research confirms this gap: recent literature reviews find that supply chain sustainability approaches remain "largely misaligned with outward-facing risk assessment, relying on compliance-based identification measures while overlooking potentially affected stakeholder perspectives."

The shift from compliance-first ESG due diligence to stakeholder intelligence requires a different architecture — one designed for AI analysis from the ground up, not tools with "AI" bolted onto legacy compliance workflows.

An AI-native approach ingests data from any source: worker voice surveys, supplier self-assessments, audit reports (PDFs), corrective action plans, policy documents, email correspondence, and grievance reports. MCP connectors integrate with existing tools like EcoVadis ratings, Sedex audit data, or raw data exports — so you don't abandon existing investments, you unify them.

This eliminates the cleanup tax. Instead of exporting data from four or five tools into spreadsheets for manual reconciliation, every data source flows into a single intelligence layer where AI can analyze it immediately.

Traditional tools produce risk scores from structured inputs. An AI-native platform reads supplier policy documents, codes open-ended worker feedback, detects sentiment shifts in grievance reports, and analyzes themes across hundreds of suppliers simultaneously.

The difference is profound. When your ESG due diligence tool can read the 200 worker interviews collected last quarter, identify that "forced overtime" emerged as a new theme in three Southeast Asian factories, connect it to the same factories flagged in last year's audit, and determine whether your corrective action actually reduced that theme — that's the leap from compliance scoring to stakeholder intelligence.

This maps directly to what Sopact Sense delivers through its Intelligent Suite: Cell-level analysis validates and normalizes individual data points, Row-level analysis summarizes each supplier's profile with evidence links, Column-level analysis identifies patterns across your supplier portfolio, and Grid-level analysis produces board-ready intelligence reports.

Every supplier, factory site, worker cohort, and remediation action gets a persistent unique ID. Due diligence assessment → corrective action → follow-up audit → worker re-survey → longitudinal trend analysis = all connected automatically.

This is the technical differentiator that makes CSDDD compliance achievable. When you need to prove your due diligence is effective over time, you need persistent identity linking every assessment, every corrective action, and every outcome for the same entities across quarters and years. Without it, you're reassembling fragments from scratch every reporting cycle.

Understanding the architectural differences between compliance-first and intelligence-first approaches helps organizations choose the right foundation for their ESG programs.

Data Collection Approach: Traditional platforms use structured questionnaires, Likert scales, and checkbox compliance forms. AI-native platforms collect structured and unstructured data — surveys, documents, interview transcripts, open-ended narratives — all designed for AI analysis from the start.

Analysis Methodology: Compliance tools aggregate risk scores and flag threshold violations. AI-native platforms read qualitative data, identify emerging themes, detect sentiment shifts, and correlate qualitative narratives with quantitative metrics across your entire portfolio.

Temporal Architecture: Traditional tools produce point-in-time snapshots — each assessment is standalone. AI-native platforms track entities longitudinally with persistent IDs, connecting assessments, corrective actions, and outcomes over time.

Scalability Model: Compliance platforms scale by adding more questionnaire templates. AI-native platforms scale by adding more data sources, more entities, and more analysis depth — without requiring additional manual review capacity.

CSDDD Readiness: Compliance tools satisfy the "conduct due diligence" requirement. AI-native platforms satisfy the harder requirement: "prove your due diligence is effective at preventing harm over time."

A modern ESG due diligence framework doesn't just check boxes once — it creates a continuous intelligence loop that adapts as your portfolio, regulations, and stakeholder expectations evolve. Here's how to structure it.

Start by mapping what you need to assess against what data you can actually collect. For private equity firms, this means portfolio companies and their supply chains. For corporate teams, it means Tier 1 suppliers (with Tier 2+ triggered by risk signals). For impact investors, it means investees and the communities they serve.

CSDDD's Omnibus I amendments (December 2025) narrowed scope to primarily Tier 1 suppliers, with "plausible information" triggers for deeper tier investigation. Design your framework around this graduated approach rather than attempting blanket coverage that dilutes quality.

An effective ESG due diligence questionnaire combines quantitative metrics with qualitative narrative fields. Most DDQ platforms only collect structured responses — missing the richest intelligence that comes from open-ended questions about actual practices, challenges, and stakeholder experiences.

Your DDQ should include quantitative fields (emissions data, diversity percentages, safety incident rates) alongside qualitative fields (policy descriptions, stakeholder engagement narratives, remediation explanations) and document uploads (audit reports, certifications, policy PDFs).

Each company, supplier, factory site, and stakeholder cohort gets a unique ID from day one. This isn't a code someone remembers — it's a system identifier that links every assessment, survey response, document submission, and corrective action across time. Without this, every quarterly review starts from scratch.

With clean, connected data, AI can do what manual review cannot: read every policy document, score every open-ended response against your rubric, identify emerging themes across hundreds of entities, and flag anomalies that warrant human attention. The team focuses on judgment calls and stakeholder relationships — not data reconciliation.

The output isn't a dashboard — it's a complete evidence trail connecting assessments to corrective actions to outcomes over time. Every score traces to source evidence. Every trend analysis shows the methodology. Every qualitative finding links to the specific narratives it's based on. This is what audit-ready ESG due diligence looks like in 2026.

A mid-market PE firm manages 30 portfolio companies across manufacturing, technology, and healthcare. Each company submits quarterly ESG data in different formats — some via PDF reports, others through structured surveys.

Before (Traditional Approach): The ESG team spends six weeks per quarter reconciling data from multiple formats. Each company's submission requires manual scoring against the firm's ESG rubric. Qualitative disclosures (governance narratives, stakeholder engagement descriptions) are read once and summarized in spreadsheets — losing nuance. LP reports arrive two months after the quarter closes, containing stale information.

After (AI-Native Approach): Every portfolio company submits through unique reference links tied to persistent IDs. Structured and unstructured data flow into the same system. AI scores quantitative metrics and reads qualitative narratives simultaneously — identifying that three healthcare companies flagged "data privacy concerns" as a rising theme before it appeared in their risk scores. The LP report generates in hours, with every finding linked to source evidence.

A consumer goods company surveys workers across 150 Tier 1 supplier factories in Southeast Asia, following CSDDD requirements for stakeholder engagement.

Before (Traditional Approach): The company uses a worker voice platform that collects Likert-scale responses on 18 standard KPI statements. Scores look acceptable. But when workers provided open-ended feedback about overtime practices, nobody analyzed those narratives at scale. A labor rights violation surfaces six months later in a factory that scored "satisfactory" on all structured KPIs.

After (AI-Native Approach): The same worker surveys include open-ended narrative questions. AI analyzes every response — identifying that "forced overtime" emerged as a theme in three factories in Q2, connecting it to the same factories flagged in last year's audit, and tracking whether the corrective action plan actually reduced that theme by Q3. The compliance team sees intelligence, not just scores.

Real estate ESG assessments add property-level environmental data (energy performance certificates, BREEAM/LEED ratings, flood risk exposure) to standard governance and social criteria. The key challenge is aggregating data across a portfolio of properties managed by different firms — each reporting in different formats and cycles.

PE firms need dual-layer ESG assessment: pre-investment screening for deal evaluation and ongoing portfolio monitoring for LP reporting. The framework must handle compressed deal timelines (weeks, not months) for pre-investment while maintaining longitudinal tracking for portfolio companies.

Vendor due diligence adds supply chain-specific criteria: modern slavery risk assessment, labor standards verification, environmental compliance for manufacturing operations, and raw material sourcing sustainability. CSDDD makes this legally required for in-scope companies, not optional best practice.

ESG due diligence is the structured assessment of a company's environmental, social, and governance practices — typically conducted before investment, acquisition, or partnership, and during ongoing portfolio monitoring. It evaluates climate risk exposure, labor practices, human rights policies, board governance, and stakeholder engagement quality to identify risks that standard financial due diligence misses.

The CSDDD, adopted May 2024, requires in-scope companies to identify, prevent, mitigate, and remediate human rights violations and environmental impacts throughout their chain of activities. Transposition is due by July 2027 with compliance starting July 2028 for the largest companies. Critically, it requires evidence that due diligence is effective — demanding continuous monitoring, not just annual audits.

An ESG due diligence checklist covers three pillars: Environmental (emissions, climate risk, resource management, compliance), Social (labor practices, human rights, diversity, stakeholder engagement), and Governance (board structure, executive accountability, ethics, reporting). A comprehensive checklist includes 20-30 assessment categories with both quantitative metrics and qualitative evaluation criteria.

AI-native ESG due diligence platforms read and analyze qualitative data (policy documents, worker feedback narratives, interview transcripts) alongside quantitative metrics. This eliminates the 80% cleanup tax on fragmented data, enables thematic analysis across hundreds of entities simultaneously, and supports longitudinal tracking that proves due diligence effectiveness over time.

ESG compliance tools score entities against checklist criteria — producing risk ratings and threshold violations. ESG intelligence platforms understand why scores change by analyzing qualitative stakeholder data, tracking entities longitudinally, and connecting corrective actions to actual outcomes. Compliance tells you a supplier scored 72/100. Intelligence tells you why the score dropped, what workers actually reported, and whether your remediation worked.

Qualitative ESG data — worker interviews, policy documents, open-ended survey responses, grievance narratives — requires AI-native analysis that performs thematic coding, sentiment detection, and pattern recognition across hundreds of suppliers simultaneously. Tools that only process structured Likert-scale data miss the richest intelligence. Look for platforms with persistent entity IDs that connect qualitative findings to specific suppliers over time.

An ESG DDQ is a structured questionnaire used to collect ESG data from companies, suppliers, or investment targets. Effective DDQs combine quantitative metrics (emissions data, diversity statistics) with qualitative narrative fields (policy descriptions, stakeholder engagement approaches) and document uploads (audit reports, certifications). The DDQ should feed directly into an analysis system rather than generating PDF reports that require manual review.

The ESG due diligence tool landscape spans compliance platforms (IntegrityNext, OneTrust, Ethixbase360), ESG rating providers (EcoVadis, MSCI), worker voice platforms (EcoVadis/Ulula), and AI-native stakeholder intelligence platforms (Sopact Sense). The best choice depends on your primary need: regulatory compliance, risk scoring, stakeholder voice collection, or unified intelligence that connects qualitative and quantitative data longitudinally.