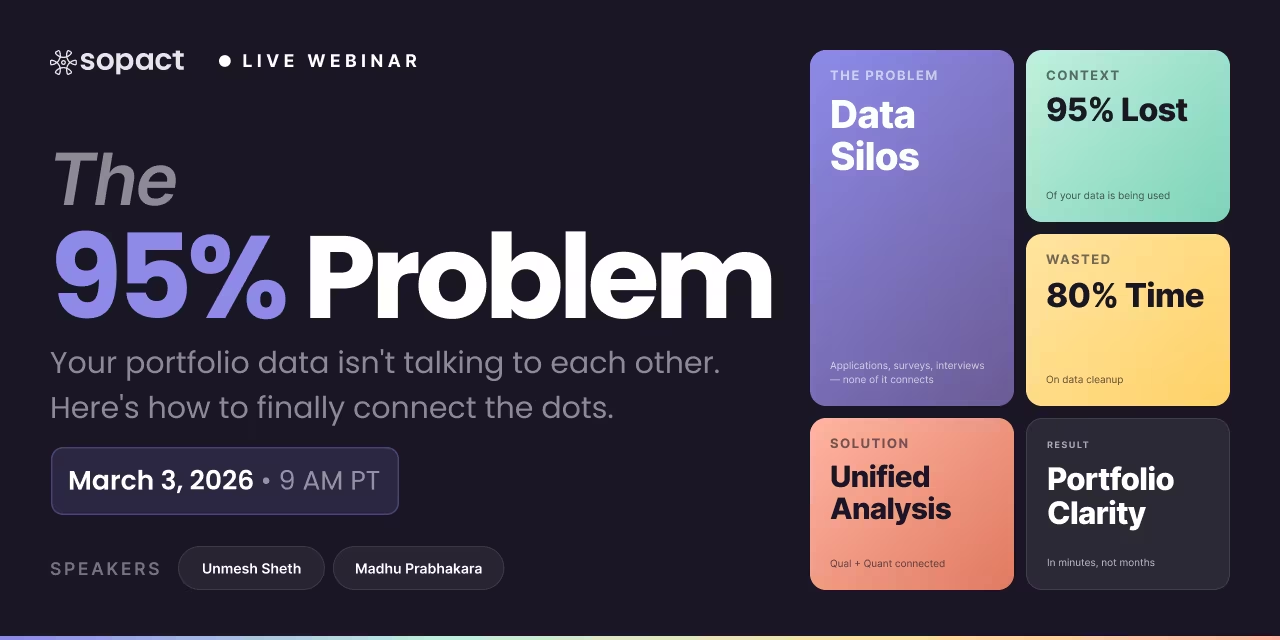

New webinar on 3rd March 2026 | 9:00 am PT

In this webinar, discover how Sopact Sense revolutionizes data collection and analysis.

Build an IMM system that produces continuous insight, not compliance reports. The Five Dimensions framework, practical implementation, and AI-native architecture explained.

TL;DR: Impact measurement and management (IMM) connects evidence of change to the decisions that improve programs, investments, and stakeholder outcomes. Most systems fail because they treat measurement as a reporting exercise rather than a continuous intelligence loop — spending 80% of time cleaning disconnected data and using only 5% of available context for decisions. The Five Dimensions of Impact (What, Who, How Much, Contribution, Risk) provide the right framework, but making them operational requires AI-native architecture: persistent stakeholder IDs, lifecycle data connectivity, integrated qualitative-quantitative analysis, and continuous reporting. Sopact Sense delivers this architecture — transforming IMM from annual compliance reporting into a real-time system that produces insight while there is still time to act on it.

Impact measurement and management (IMM) is the practice of systematically collecting evidence of change, analyzing what that evidence means, and using the findings to improve programs, inform investment decisions, and drive better outcomes for stakeholders. It closes the loop between data and action — where measurement asks "What changed?" and management asks "What do we do about it?"

The distinction between measurement and management matters because the field spent fifteen years getting better at measurement without building management into the system. Organizations learned to collect more data, produce more reports, and align with more frameworks — but the reports sat on shelves, the data informed nothing, and program decisions continued to be made on instinct. This is the fundamental gap IMM addresses: evidence that actually reaches decision-makers while there is still time to act on it.

In 2026, the most advanced version of IMM is emerging as stakeholder intelligence — a continuous, AI-native practice that turns fragmented stakeholder data into persistent, actionable understanding across the full lifecycle. This article explains how to build an IMM system that delivers this level of insight.

Bottom line: IMM transforms evidence from a compliance exercise into a continuous system for learning — but only when the architecture connects data collection to analysis to decisions in a single loop.

Impact measurement fails because of three structural flaws: misalignment between what funders demand and what organizations build, disconnected data across separate tools with no persistent stakeholder identifiers, and capacity constraints that make complex implementations impossible for the teams doing the actual work. Organizations spend 80% of their time cleaning data and use only 5% of available context for decisions.

Funders said they wanted to understand impact and learn what works. What they actually drove was metrics collection for board summaries. Grantees complied — collecting data to satisfy reporting requirements without building capacity for genuine learning. The result: a culture of "whatever the funder wants" that produces output reporting disguised as impact measurement.

Applications live in one system. Surveys in another. Interview transcripts in documents. Financial data in spreadsheets. No persistent identifier links a stakeholder's intake data to their outcomes. A funder with 20 grantees can see that 15 reported "improved outcomes" but cannot answer why outcomes improved at some organizations and stalled at others — because the qualitative evidence never connects to the quantitative metrics.

The organizations doing impact work have no data engineers, no analysts, and maybe one M&E coordinator. Any solution requiring 6-month implementations, specialist staff, or enterprise-scale technology fails for the majority of the market. This is why Salesforce implementations stall, managed-services models don't scale, and framework-first approaches fail at adoption.

Bottom line: Impact measurement doesn't fail because organizations don't care — it fails because disconnected tools, misaligned incentives, and capacity constraints make genuine learning architecturally impossible.

A working IMM system operates as a continuous four-step cycle — collect, analyze, decide, adapt — where each step feeds the next automatically and evidence reaches decision-makers while there is still time to change outcomes. The cycle runs continuously rather than annually, producing insight in days instead of months.

The IMM cycle begins with collecting multi-source evidence — surveys, documents, interviews, applications — all under persistent unique IDs that link every data point to a specific stakeholder across their entire lifecycle. This data flows into AI-native analysis that processes qualitative and quantitative evidence simultaneously, extracting themes from open-ended responses while correlating them with outcome metrics. The analysis produces evidence-based decisions: program managers adjust delivery, investors inform follow-on decisions, funders reallocate resources. And the adjusted programs generate new evidence, building on what was learned — a Theory of Change that evolves from data, not assumption.

Bottom line: The IMM cycle is continuous — not annual. Evidence informs decisions while there is still time to change outcomes, and each cycle builds on everything that came before.

The Five Dimensions of Impact, developed by the Impact Management Project (now Impact Frontiers), are the consensus framework for organizing impact evidence. They ask five questions about any outcome: What, Who, How Much, Contribution, and Risk. Understanding these dimensions is not the hard part — making them operational across every data collection cycle is.

This dimension requires defining the specific changes you are tracking — improvements in knowledge, behavior, economic status, health, or any other domain. The critical decision is specificity: "improved wellbeing" is unmeasurable; "increased confidence in job-seeking as measured by self-assessment and interview performance" is operational. Define 3-5 specific outcomes per program, each with at least one quantitative indicator and one qualitative evidence source. Use a theory of change to connect activities to expected changes.

This dimension requires understanding the characteristics, context, and vulnerability of the stakeholders affected. Demographic analysis alone is insufficient — you need to understand whether outcomes differ by context, starting conditions, or stakeholder characteristics. Collect demographic and contextual data at intake, linked to outcome data through persistent unique IDs. Use AI analysis to segment outcomes by stakeholder characteristics and identify equity patterns.

This dimension examines scale (how many people), depth (how much change per person), and duration (how long the change lasts). It is the dimension organizations handle worst because it requires longitudinal tracking — connecting pre-program assessments to post-program outcomes to 6-month follow-up data through the same persistent identifier. Without longitudinal architecture, "how much" becomes a guess.

The most technically challenging dimension asks what would have happened without your intervention. Full counterfactual analysis is expensive and often impractical, but contribution evidence can still be gathered through stakeholder attribution (asking participants what they believe caused the change), comparison groups, and qualitative evidence from interviews. AI can analyze open-ended attribution responses at scale, identifying common causal narratives across cohorts.

This dimension forces honest assessment of risk that outcomes don't materialize, risk that unintended negative consequences occur, and risk that impact is not sustained. Managing risk requires ongoing monitoring — build risk indicators into regular qualitative data collection and use AI to flag anomalies that indicate brewing problems before they appear in quantitative metrics.

Bottom line: The Five Dimensions require both qualitative and quantitative evidence — without AI-native qualitative analysis, Dimensions 1, 4, and 5 remain theoretical rather than operational.

Building a working IMM system requires four architectural pillars: clean data at source, lifecycle connectivity, integrated qualitative-quantitative analysis, and continuous reporting. Frameworks tell you what to measure. Architecture determines whether you actually can. The gap between IMM aspiration and reality is almost always architectural.

Clean data at source means preventing dirty data rather than trying to clean it afterward — the single most important architectural decision. Assign a persistent unique identifier to every stakeholder at their first interaction, one that follows them through every survey, document upload, application, interview, and follow-up cycle. Build deduplication into the collection process. Enable stakeholder self-correction through secure links where participants review and update their own information. Without this, every downstream process is compromised by the "80% cleanup problem."

Lifecycle connectivity matters because IMM requires following stakeholders across time — from intake through program delivery through outcomes through follow-up. A scholarship applicant's motivation essay, their pre-program assessment, their mid-program reflection, their post-program outcomes, and their one-year follow-up employment status must all connect to one profile. Context from intake pre-populates follow-up. The narrative builds itself over time.

Integrated qualitative-quantitative analysis eliminates the separation between text analysis and number crunching that has plagued the field for decades. The Five Dimensions demand qualitative evidence — stakeholder attribution for Contribution, narrative evidence for What, emerging themes for Risk — but legacy approaches treat qual and quant as separate workflows requiring separate tools (NVivo for qual, Excel for quant). AI-native architecture processes both simultaneously: the same platform tracks quantitative metrics, analyzes open-ended responses, extracts themes from interview transcripts, and correlates qualitative patterns with quantitative outcomes.

Continuous reporting means evidence reaches decision-makers while there is still time to act — not in an annual impact report that's stale by the time it arrives. Program managers see cohort progress in real-time. Funders access portfolio views updated with every new data point. Board members receive evidence-based summaries highlighting trends, risks, and recommendations. The shift from annual to continuous is what transforms IMM from a compliance exercise into a management tool.

Bottom line: Architecture — not frameworks — determines whether IMM actually works. Clean-at-source data, persistent IDs, integrated analysis, and continuous reporting are the four non-negotiable pillars.

Investors and operating organizations need different views of the same data, not different systems. Impact investors focus on portfolio-level patterns and Dimensions 4 (Contribution) and 5 (Risk) to demonstrate additionality. Nonprofits focus on program-level improvement and Dimensions 2 (Who) and 3 (How Much) to ensure equitable outcomes and demonstrate depth of change.

Impact investors need to understand which investments generate the strongest outcomes relative to expectations, how outcomes vary across sectors or geographies, and where risk indicators suggest intervention. The investor IMM workflow connects impact investing due diligence data to quarterly reporting: DD establishes baseline expectations → quarterly reporting aggregates across the portfolio → AI analysis identifies outliers and patterns → investment committee receives evidence-based recommendations → follow-on decisions incorporate impact data alongside financial returns.

Operating organizations — nonprofits, accelerators, workforce programs — focus on which program components drive the strongest results, where participants struggle, and how to adapt delivery while programs are still running. The enterprise IMM workflow: intake data establishes baselines → program delivery generates continuous evidence → AI analysis identifies patterns in real-time → program managers adjust delivery mid-cycle → outcome data proves what worked → funder reports include evidence-based recommendations for the next cycle.

The critical insight: a well-architected IMM platform provides portfolio views for investors while simultaneously providing program views for operators — all drawing from the same clean, connected data. This is why architectural decisions matter more than framework choices.

Bottom line: Investors and enterprises need the same underlying architecture — clean data, lifecycle connectivity, integrated analysis — but different analytical views optimized for portfolio management versus program improvement.

Most organizations attempting IMM in 2026 rely on disconnected tool stacks where survey tools handle data collection, spreadsheets handle analysis, grant platforms handle workflow, and enterprise CRMs handle stakeholder data — with no system connecting these sources. Every category has fundamental gaps that prevent genuine impact measurement and management.

Survey tools (Google Forms, SurveyMonkey, Typeform) create disconnected datasets with each collection cycle, have no way to link quarterly submissions to the same stakeholder's previous responses, and export open-ended narrative responses to spreadsheet columns nobody reads. Grant management platforms (Fluxx, Foundant, SmartSimple) manage the workflow — applications, reviews, disbursements — but not the intelligence, tracking compliance milestones rather than outcomes.

Enterprise platforms (Salesforce, Blackbaud, Bonterra) require 3-6 month implementations, dedicated administrators, and significant budgets. They are designed for fundraising CRM, not for collecting outcome data from external partners. And legacy qualitative analysis tools (NVivo, ATLAS.ti, MAXQDA) could analyze narrative data rigorously — if organizations hired researchers, exported data from other systems, coded it manually for weeks, then exported it again.

The market collapse is instructive: purpose-built impact measurement platforms like Social Suite, Sametrics, and Proof have shut down, pivoted to ESG, or ceased operations. This is not individual company failure — it's market failure driven by the same architectural gaps this article describes.

Bottom line: The tool landscape is fragmented because no legacy tool was designed for the end-to-end architecture IMM requires — clean data, lifecycle connectivity, integrated qual+quant, and continuous reporting in one system.

AI-native architecture makes it possible to implement a working IMM system in weeks rather than the months or years required by enterprise platforms. Start with existing data — documents, surveys, interview transcripts you already have — and let AI analysis deliver first insights before any new data collection begins.

Upload existing documents, reports, and datasets into Sopact Sense. AI generates scoring rubrics, extracts themes from qualitative data, and produces an initial evidence synthesis. This phase proves value immediately — before any process changes.

Design data collection instruments with persistent unique IDs, deduplication, and stakeholder self-correction built in. Replace disconnected survey forms with connected data collection that links every response to a specific stakeholder profile.

Connect collected data to automated reporting. Program managers see dashboards updated with each new data point. Funders receive qualitative and quantitative measurements combined in evidence-based summaries. Board packs generate in minutes instead of weeks.

Add new programs, stakeholder groups, or data sources. Each cycle builds on the last — Theory of Change evolves from evidence, risk indicators improve with historical context, and portfolio-level patterns become visible. The system gets smarter with every interaction.

Bottom line: Start with what you have, prove value in weeks, and expand as the system demonstrates ROI — this is the opposite of the 6-month enterprise implementation that has failed the impact sector for a decade.

The five most common IMM mistakes stem from the same root cause: building measurement systems that cannot support management decisions. Organizations confuse output reporting with outcome measurement, design 400-question surveys that produce compliance data instead of insight, treat qualitative and quantitative analysis as separate workflows, build annual reporting cycles too slow for course correction, and rely on frameworks without the architecture to make them operational.

Counting people served is not impact measurement. The number of participants tells you nothing about what changed for those participants, whether changes were equitable across groups, or whether your program caused the change. Operational IMM requires outcome data — pre/post comparisons, longitudinal tracking, stakeholder attribution — all linked by persistent IDs.

When data collection is designed to satisfy funder requirements rather than produce organizational learning, you get 400-question instruments that produce compliance data nobody analyzes. Design data collection around 3-5 critical outcomes. Use open-ended questions that AI can analyze at scale. Collect broad context rather than narrow metrics.

Numbers without stories are meaningless. Stories without numbers are anecdotal. When qualitative evidence lives in separate tools (NVivo, Word documents, email threads) from quantitative metrics (Excel, SPSS, survey platforms), the most valuable analysis — correlating what participants say with what the metrics show — never happens.

By the time an annual impact report arrives, the program has moved on. Course corrections are impossible. The evidence is stale. Organizations need continuous reporting where insights arrive while there is still time to act — quarterly at minimum, monthly for fast-moving programs.

Choosing a framework (Five Dimensions, Theory of Change, IRIS+) is the easy part. The hard part is building the architecture that makes the framework operational: persistent IDs, lifecycle connectivity, integrated analysis, and continuous reporting. Without architecture, frameworks remain aspirational.

Bottom line: Every common IMM mistake traces back to the same root cause — measurement systems that cannot support management decisions because the architecture was never designed for it.

Impact measurement and management (IMM) is the practice of systematically collecting evidence of change, analyzing what it means, and using those findings to improve programs, inform investment decisions, and drive better stakeholder outcomes. Where measurement asks "What changed?" management asks "What do we do about it?" Together they form a continuous cycle connecting data to action.

Impact measurement fails because of three structural flaws: misalignment between funder reporting demands and genuine learning systems, disconnected data across separate tools with no persistent stakeholder identifiers (organizations use only 5% of available context), and capacity constraints where teams lack data engineers, analysts, or technology infrastructure to maintain complex systems.

The Five Dimensions of Impact are the consensus framework developed by the Impact Management Project (now Impact Frontiers): What outcome occurred, Who experienced the change, How Much change happened (scale, depth, duration), what is the Contribution (additionality versus what would happen anyway), and what Risk exists that impact differs from expected. Making them operational requires both qualitative and quantitative evidence.

Impact measurement focuses on collecting and analyzing evidence of change. Impact management extends this into ongoing decision-making — adjusting programs, reallocating resources, and informing strategy based on what the evidence shows. The field spent fifteen years improving measurement without building management into the system, which is why most organizations produce reports nobody reads.

AI transforms impact measurement by eliminating manual bottlenecks: it analyzes open-ended qualitative responses at scale, extracts themes from documents and interviews, matches pre/post data automatically using persistent IDs, detects anomalies and early warning signals, and generates evidence-based reports in minutes instead of months. The key distinction is AI-native architecture designed for intelligence from day one versus AI bolted onto legacy tools.

An effective IMM system requires four architectural pillars: clean data at source (persistent unique IDs, deduplication at collection, stakeholder self-correction), lifecycle connectivity (data linked across intake, delivery, and outcomes), integrated qualitative-quantitative analysis (one platform processing both data types simultaneously), and continuous reporting (real-time insights rather than annual reports).

A Theory of Change maps the causal pathway from activities to outcomes: inputs → activities → outputs → outcomes → impact. For effective IMM, it should function as a living hypothesis updated quarterly as evidence accumulates — not a static diagram filed during the proposal stage. AI-native platforms can auto-generate and update the Theory of Change from actual program data.

Investors focus on portfolio-level patterns and Dimensions 4 (Contribution) and 5 (Risk) to demonstrate additionality. Nonprofits focus on program-level improvement and Dimensions 2 (Who) and 3 (How Much) to ensure equitable outcomes. Both need the same underlying architecture — clean data, lifecycle connectivity, integrated analysis — but different analytical views.

Most organizations rely on disconnected stacks: survey tools for collection, spreadsheets for analysis, grant platforms for workflow, and CRMs for stakeholder data. The core problem is no tool connects these sources. Purpose-built impact measurement platforms have largely shut down or pivoted. AI-native platforms like Sopact Sense unify collection, analysis, and reporting in one system.

With AI-native architecture, implementation starts in weeks. Organizations begin by uploading existing documents and data, with AI delivering first insights before any new data collection begins. Phase 2 configures clean-at-source collection with persistent IDs. Phase 3 activates continuous reporting. Full operational capability within 4-6 weeks versus 3-6 months for enterprise platforms.